Netherlands Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Netherlands Defense Market Report Overview

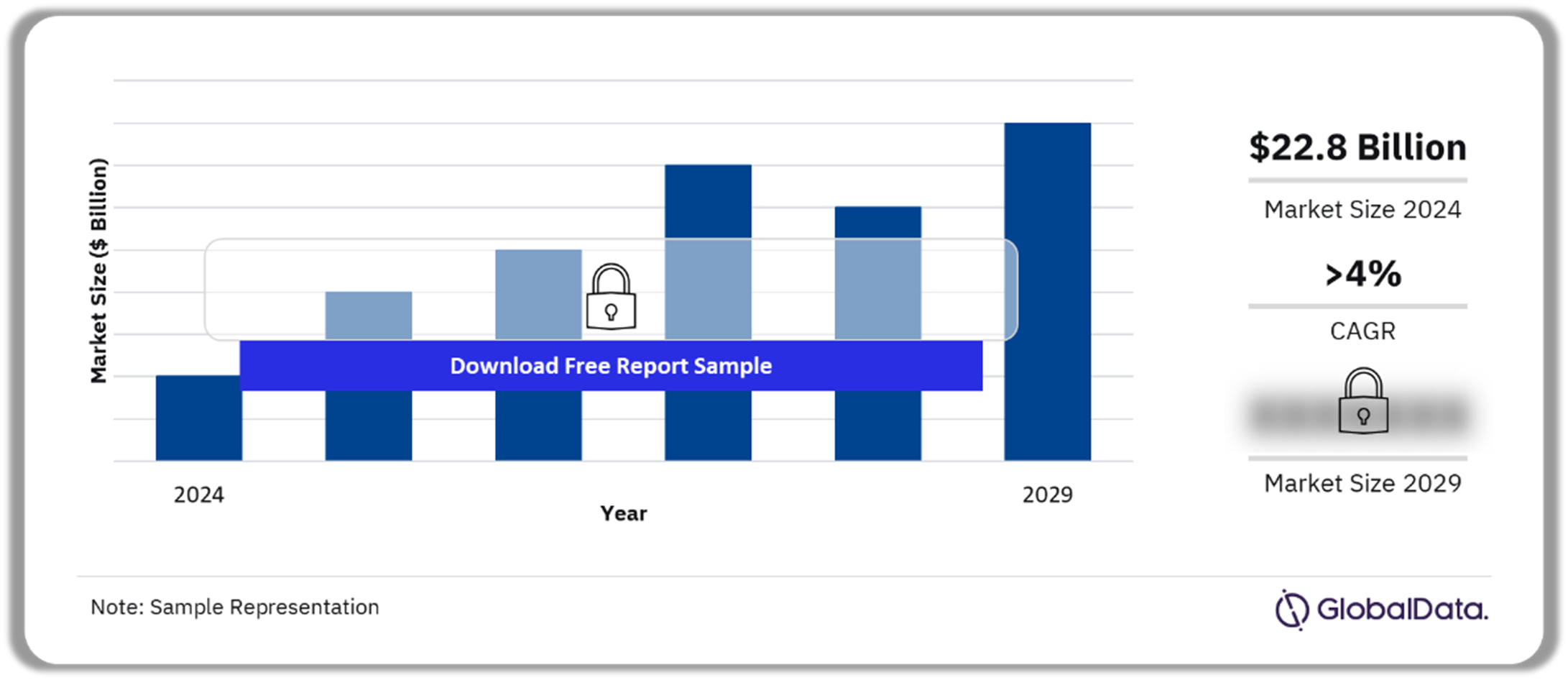

As of 2024, the Netherlands defense budget is worth $22.8 billion. The country’s defense budget experienced a sudden increase in 2024, as the Dutch government adjusted to the reality of war on the European continent. Furthermore, Russia’s invasion of Ukraine has compelled the Netherlands to reinforce its defense posture, as it hopes to deter and defend against further Russian aggression. Against the backdrop of war in Europe, the country’s defense budget will grow at a CAGR of more than 4% during 2025-2029.

Netherlands Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the Netherlands’ Defense Market Forecast

The Netherlands defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Netherlands defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $22.8 billion |

| CAGR (2025-2029) | >4% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Conflict in Ukraine

· Modernization · Domestic and Foreign NATO considerations |

| Key Sectors | · Missiles and Missile Defense Systems

· Naval Vessels and Surface Combatants · Tactical Communication Systems · Military Fixed Wing Aircraft · Submarines · Others |

| Leading Companies | · Airbus SE

· KPMG International Coop · STMicroelectronics NV · VEON Ltd · Lockheed Martin Corp |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Netherlands Defense Market Drivers

The key factors driving the Dutch defense market growth are conflict in Ukraine, modernization, and domestic and foreign NATO considerations.

Conflict in Ukraine: The conflict in Ukraine is a major driver of Dutch defense expenditure, with the country committing to a significant increase in overall procurement and military spending. The acquisitions include frigates, submarines, and fighter jets, as well as artillery and air defense systems, which will significantly modernize the Netherlands’ military forces. The country is aiming to spend more than 2% of its GDP on defense spending from 2025 onwards, leading to ongoing growth.

Buy the Full Report for Additional Information on the Netherlands’ Defense Market Drivers

Netherlands Military Doctrines and Defense Strategies

The Netherlands’ military doctrine relies on high readiness and deployability to address diverse current and future threats. Agility and firepower are also key to the country’s military doctrine, and this will be a focus in the coming years.

The Netherlands reiterates in recent strategy documents that replenishing stocks and tackling maintenance backlogs are key to military capabilities. This is particularly significant in the wake of the conflict in Ukraine since the country has donated equipment including MANPAD launchers, Panzerfaust weapons, UAVs, and YPR-765 armored personnel carriers. These donations will leave the armed forces in need of replenishment and will drive strategy in the coming years.

Buy the Full Report for More Insights into the Dutch Military Doctrines and Defense Strategies

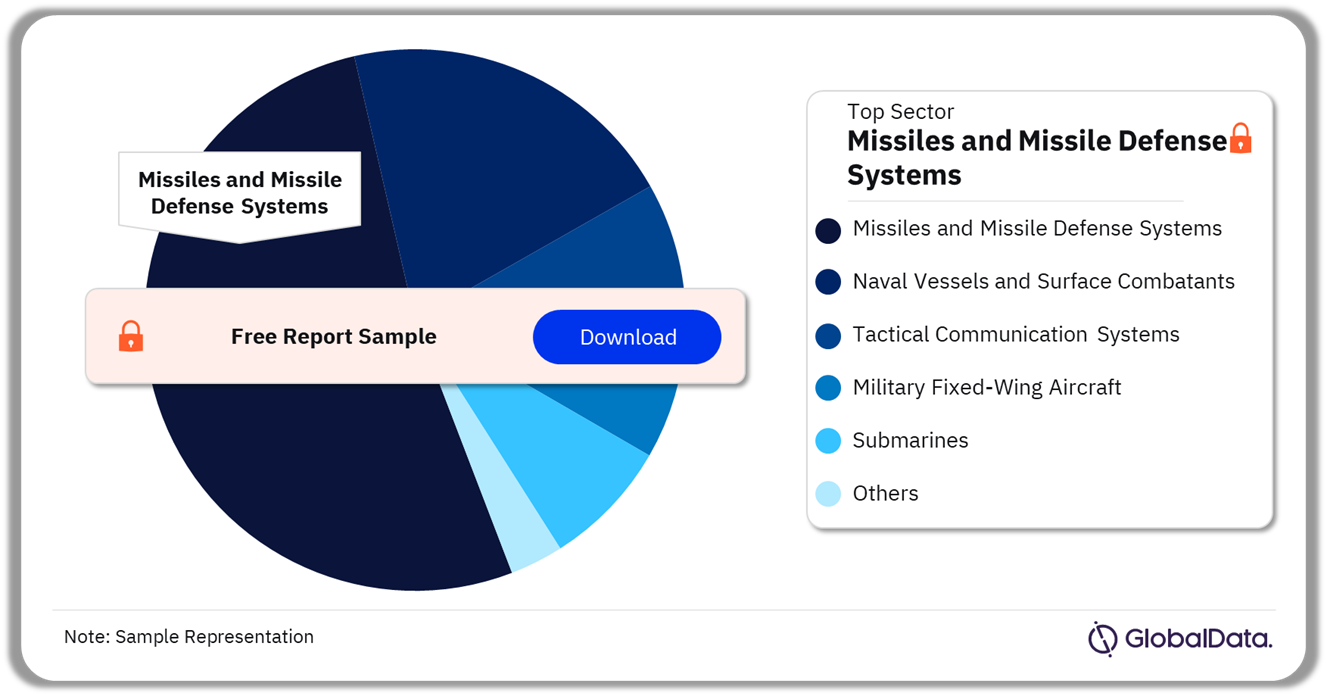

Netherlands Defense Market Segmentation by Sectors

The key sectors in the Netherlands defense market are missiles and missile defense systems, naval vessels and surface combatants, tactical communication systems, military fixed-wing aircraft, and submarines among others. In 2024, missiles and missile defense systems accounted for the highest share of the Netherlands’ defense market, followed by naval vessels and surface combatants.

Netherlands Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Netherlands’ Defense Market

Netherlands Defense Market - Competitive Landscape

A few of the leading defense companies operating in the Netherlands are:

- Airbus SE

- KPMG International Coop

- STMicroelectronics NV

- VEON Ltd

- Lockheed Martin Corp

Headquartered in Maryland, the US, Lockheed Martin Corp, provides advanced technology systems and products for defense, civil and commercial applications. The company also offers support and upgrade services for military aircraft, cybersecurity, ground vehicles, missile defense systems, satellites, and space transportation systems. It serves the US government and commercial customers. The company has business operations in the Americas, Africa, Europe, Asia-Pacific, and the Middle East.

Netherlands Defense Market Analysis by Companies

Buy the Full Report for More Insights into the Leading Companies in the Netherlands’ Defense Market

Segments Covered in the Report

Netherlands Defense Market Sectors Outlook (Value, $ Billion, 2020-2029)

- Missiles and Missile Defense Systems

- Naval Vessels and Surface Combatants

- Tactical Communication Systems

- Military Fixed Wing Aircraft

- Submarines

Scope

The report provides:

- A detailed analysis of the Netherlands 2024 defense budget broken down into market size and market share.

- An analysis of the factors that influence demand for the industry, key market trends, and challenges faced by industry participants.

- An explanation of the procurement policy and process.

- An analysis of the Netherlands’s military doctrine and strategy to provide a comprehensive overview of the Netherlands’s military procurement regulation.

- An outline of political alliances and perceived security threats to the Netherlands and trends in spending and modernization.

- An analysis of the competitive landscape and strategic insights of the Netherlands’s defense industry.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Netherlands’ defense market over the next five years

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the Netherlands market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Netherlands defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Netherlands government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available,

KPMG International Coop

STMicroelectronics

NV VEON Ltd

Damen Shipyards Group

TKH Group NV

Fugro NV

TomTom NV

ICTS International NV

HITT NV

Aeronamic BV

Aeronautical Information Service

Airborne International BV

Airbus Netherlands BV

DSM Dyneema BV

Eonic B.V.

FLIR Systems BV

Fujitsu Technology Solutions (Holding) BV

GeoCat BV

Golem Protection

Hatenboer-Water BV

Hiber BV

KMW+Nexter Defense Systems NV

Koninklijke Ten Cate NV

Ministry of Defence (Netherlands)

NEDAERO COMPONENTS B.V.

Northrop Grumman

Sperry Marine BV

ORGA Aviation BV

Rescue 3 Benelux RH

Marine Netherlands BV

Rheinmetall Nederland BV

Robin Radar Systems BV

Royal Netherlands Army

Royal Netherlands Navy

Silver Aerospace B.V.

Sim-Industries BV

SkyGeo Netherlands BV

Stork Aerospace Services Stork BV

SurCom International BV

Teijin Aramid BV

Thales Nederland B.V.

Van Halteren Groep

Van Riemsdijk Rotterdam BV

VSTEP BV

Table of Contents

Frequently asked questions

-

What is the Netherlands' defense market size in 2024?

The defense market size in the Netherlands is $22.8 billion in 2024.

-

What will the Netherlands defense market growth rate be during the forecast period?

The defense market in the Netherlands will achieve a CAGR of more than 4% during 2025-2029.

-

Which sector holds the highest share of the Netherlands defense market in 2024?

Missiles and missile defense systems hold the highest share in the Netherlands defense market in 2024.

-

Which are the key companies operating in the Netherlands defense market?

A few of the leading defense companies operating in the Netherlands are Airbus SE, KPMG International Coop, STMicroelectronics NV, VEON Ltd, and Lockheed Martin Corp.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports