Oman Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Oman Defense Market Report Overview

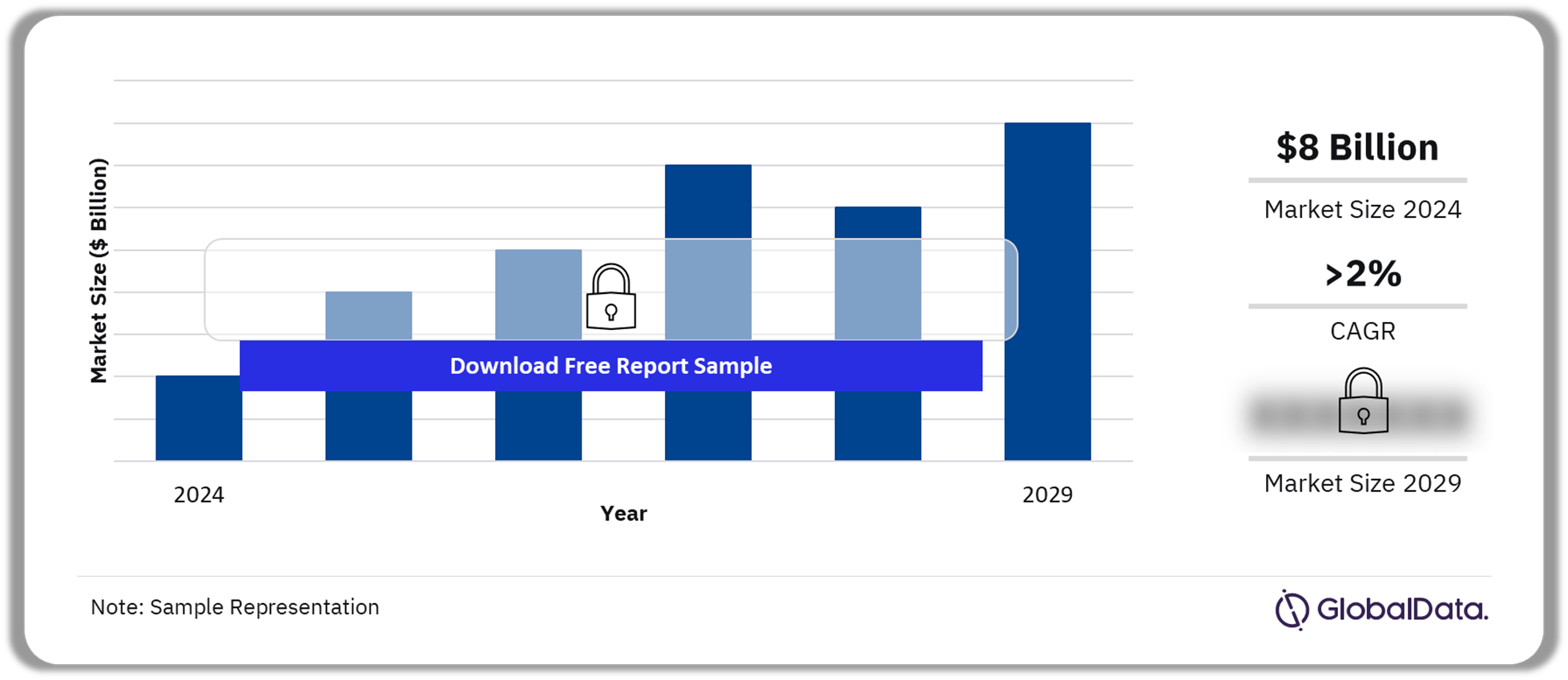

The Oman defense budget is $8 billion in 2024. The country’s defense budget will grow at a CAGR of more than 2% during 2025-2029. This can be attributed to the rising arms race in the region to intercept the growing turbulence in neighboring countries such as Syria and Yemen. In addition, the increase in oil prices will facilitate increases in Oman’s defense budget.

Oman Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the Oman Defense Market Forecast

The Oman defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Oman defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $8 billion |

| CAGR (2025-2029) | >2% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Border protection and instability in neighboring areas

· Strengthening the capability of Oman’s armed forces |

| Key Sectors | · Military Land Vehicles

· Military Fixed-Wing Aircraft · Ammunition · Missile and Missile Defense Systems · Electro-optical/Infrared (EO/IR) Systems |

| Leading Companies | · Lockheed Martin Corp

· FNSS Savunma Sistemleri AS (FNSS) · Insitu Inc · Hyundai Rotem Co · Bahwan Engineering Co LLC |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Oman Defense Market Drivers

Border protection and instability in neighboring areas and strengthening the capability of the country’s armed forces are the key factors driving the Omani defense expenditure.

Border protection and instability in neighboring areas: Oman has an extensive land area bordering Saudi Arabia, Yemen, and the UAE. The major factors driving investment in military infrastructure and logistics are the protection and fortification of its borders with Yemen to check the influence of Islamic State (IS) and prevent the spillover of the civil war in Yemen into Omani territory. Oman’s geopolitical boundaries with Yemen, Saudi Arabia, and especially with the UAE play a very important role in its behavior.

Buy the Full Report for Additional Information on the Oman Defense Market Drivers

Oman Military Doctrines and Defense Strategies

The Royal Office is one of the most senior and therefore powerful ministries in the Sultanate of Oman. It is a government body that has key influence over national security and intelligence issues. Oman’s defense and national security council aims to enhance coordination and integration among various security agencies, streamline decision-making processes, and improve the country’s overall defense capabilities.

Oman has often been referred to as an ‘Oasis of peace’ in a region wrecked by conflict. For decades, Oman maintained ‘strategic neutrality’ in the volatile Middle East, particularly in the late Sultan Qaboos’s era. The Iran-US nuclear accord, signed in 2015, was made possible by Oman’s mediation. Oman has remained a neutral player and has maintained relations with almost all the key powers in the region.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the Oman Defense Market

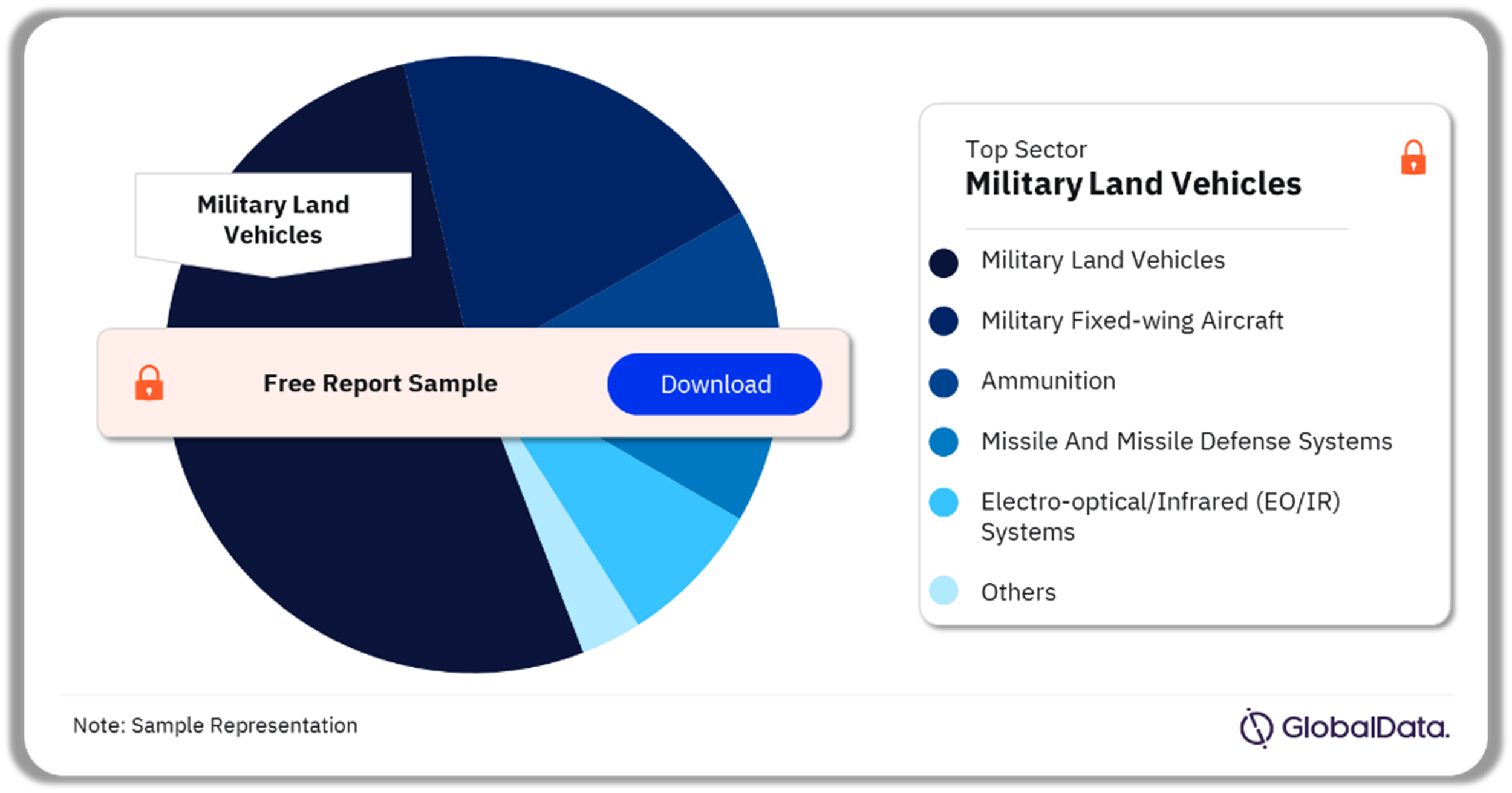

Oman Defense Market Segmentation by Sectors

The key sectors in the Oman defense market are military land vehicles, military fixed-wing aircraft, ammunition, missile and missile defense systems, and electro-optical/infrared (EO/IR) systems among others. In 2024, the military land vehicles sector has the highest share of the Oman defense market, followed by military fixed-wing aircraft.

Oman Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Oman Defense Market

Oman Defense Market - Competitive Landscape

A few of the leading defense companies operating in Oman are:

- Lockheed Martin Corp

- FNSS Savunma Sistemleri AS (FNSS)

- Insitu Inc

- Hyundai Rotem Co

- Bahwan Engineering Co LLC

Lockheed Martin Corp (Lockheed Martin) provides advanced technology systems and products for defense, civil and commercial applications. The company offers management, technical, engineering, scientific, logistics, and information services. Lockheed Martin provides support and upgrade services for military aircraft, cybersecurity, ground vehicles, missile defense systems, satellites, and space transportation systems.

Oman Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the Oman Defense Market

Segments Covered in the Report

Oman Defense Market Sectors Outlook (Value, $ Billion, 2020-2029)

- Military Land Vehicles

- Military Fixed-Wing Aircraft

- Ammunition

- Missile and Missile Defense Systems

- Electro-optical/Infrared (EO/IR) Systems

Scope

The report provides:

- Oman defense budget: detailed analysis of the Oman 2023 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Regulation: the procurement policy and the process is explained. This is coupled with an analysis of the Oman military doctrine and strategy to provide a comprehensive overview of Oman’s military regulation.

- Security Environment: political alliances and perceived security threats to Oman are examined; they help to explain trends in spending and modernization.

- Competitive landscape and strategic insights: analysis of the competitive landscape of Oman’s defense industry.

Key Highlights

- During the historic period, 2020–24, Oman’s defense expenditure registered a negative CAGR of 2.9%. As part of its initial response to lower oil prices and COVID-19, by May 2020, the Omani Ministry of Finance (MoF) had announced that the defense and security budget would be cut, and the country’s development budget had also been reduced. The defense budget was reduced from $9 billion in 2020 to $8 billion in 2024. The acquisition budget was reduced from $1.7 billion in 2020 to $1.4 billion in 2024.

- The ongoing tensions and security challenges in neighboring countries pose a security challenge to neutral Oman. The fortification of its borders with Yemen coupled with rising instances of Houthi attacks on mercantile shipping are one major driver of expenditure.

- Military land vehicles, Military Fixed-Wing Aircraft and Ammunition are the top three largest sectors within the Omani defense market. The military land vehicles is the single largest sector in the Omani defense market. The sector is powered by the growth in the Main Battle Tank segment. The segment is anticipated to grow from $38 million in 2024 to reach $56.9 million in 2029. Cumulatively the sector is anticipated to value $378.1 million over the period 2024-29.

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Oman defense market over the next five years

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the Oman market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Oman defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Oman government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

FNSS Savunma Sistemleri AS (FNSS)

Insitu Inc

Table of Contents

Frequently asked questions

-

What is the Oman defense market size in 2024?

The defense market size in Oman is $8 billion in 2024.

-

What will the Oman defense market growth rate be during the forecast period?

The defense market in Oman is expected to achieve a CAGR of more than 2% during 2025-2029.

-

Which sector holds the highest share of the Oman defense market in 2024?

Military land vehicles was the leading Oman defense market sector in 2024.

-

Which are the key companies operating in the Oman defense market?

A few of the leading defense companies operating in Oman are Lockheed Martin Corp, FNSS Savunma Sistemleri AS (FNSS), Insitu Inc, Hyundai Rotem Co, and Bahwan Engineering Co LLC among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports