United Arab Emirates (UAE) Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Arab Emirates (UAE) Defense Market Report Overview

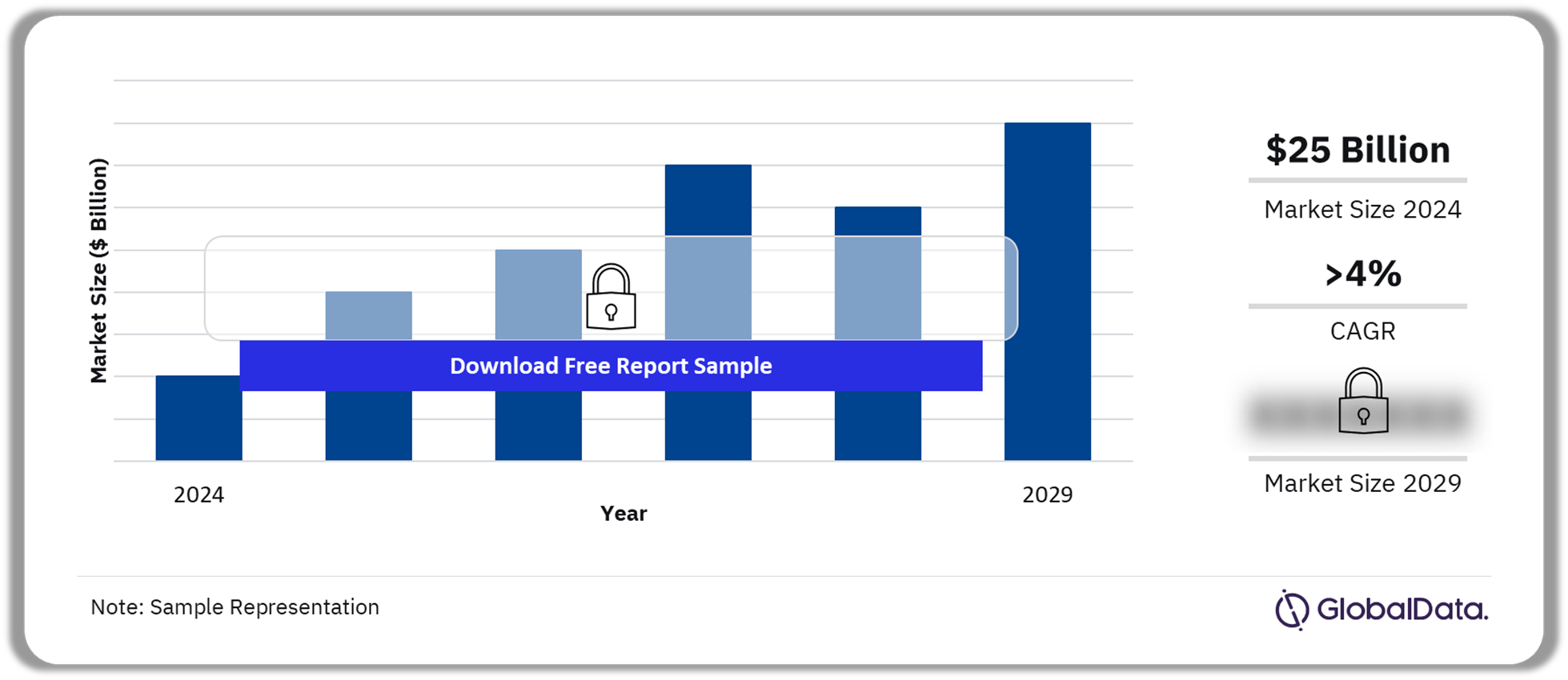

The United Arab Emirates (UAE) defense budget is estimated to be valued at $25 billion in 2024, due to the need to finance procurements. The country’s defense budget will grow at a CAGR of more than 4% during 2025-2029, owing to the need to modernize the UAE Defense and Security Forces, with specific emphasis on counter-insurgency measures.

United Arab Emirates (UAE) Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the UAE Defense Market Forecast

The United Arab Emirates (UAE) defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The United Arab Emirates defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $25 billion |

| CAGR (2025-2029) | >4% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Modernization of the UAE Armed Forces

· Counter-insurgency and anti-terrorism initiatives |

| Key Sectors | · Military Fixed Wing Aircraft

· Ammunition · Military Unmanned Aerial Vehicles · Military Rotorcraft · Military Satellite |

| Leading Companies | · Saab

· BAE Systems · Raytheon · Rolls Royce · Northrop Grumman |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

United Arab Emirates (UAE) Defense Market Drivers

The key factors driving the UAE defense market are the modernization of the armed forces and counter-insurgency and anti-terrorism initiatives taken by the government.

Modernization of the UAE armed force: The UAE’s emphasis on maintaining a strong independent defense posture is reflected in its defense modernization initiatives undertaken over the last decade. The country has consistently ranked as one of the top defense spenders in the region and has amassed a significant number of high-end defense equipment. The country’s defense modernization efforts are mainly centered around C4ISR, anti-ballistic missile systems, fighter aircraft, and armored vehicles, among others.

Buy the Full Report for More Information on the UAE Defense Market Drivers

United Arab Emirates (UAE) Military Doctrines and Defense Strategies

Although the UAE perceives Iran to be its primary strategic regional threat, it has still adopted a policy of strategic hedging against Iran. The country has maintained a transactional relationship with Iran, which encompasses diplomatic and commercial ties, all the while forging and strengthening its security alliances with the US and neighboring Saudi Arabia. The key rationale behind this policy has been to avert an all-out confrontation with Iran.

The new Emirati strategy favors a proactive defense posture and is credited to Mohamed bin Zayed, the deputy supreme commander of the UAE Armed Forces. Additionally, The UAE maintains a good relationship with its regional neighbors, as well as the US and France. The country has established diplomatic relations with more than 60 countries, including Japan, South Korea, Russia, India, Pakistan, Nepal‚ China, and most Western European countries, and is a member of the UN and the Arab League.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the UAE Defense Market

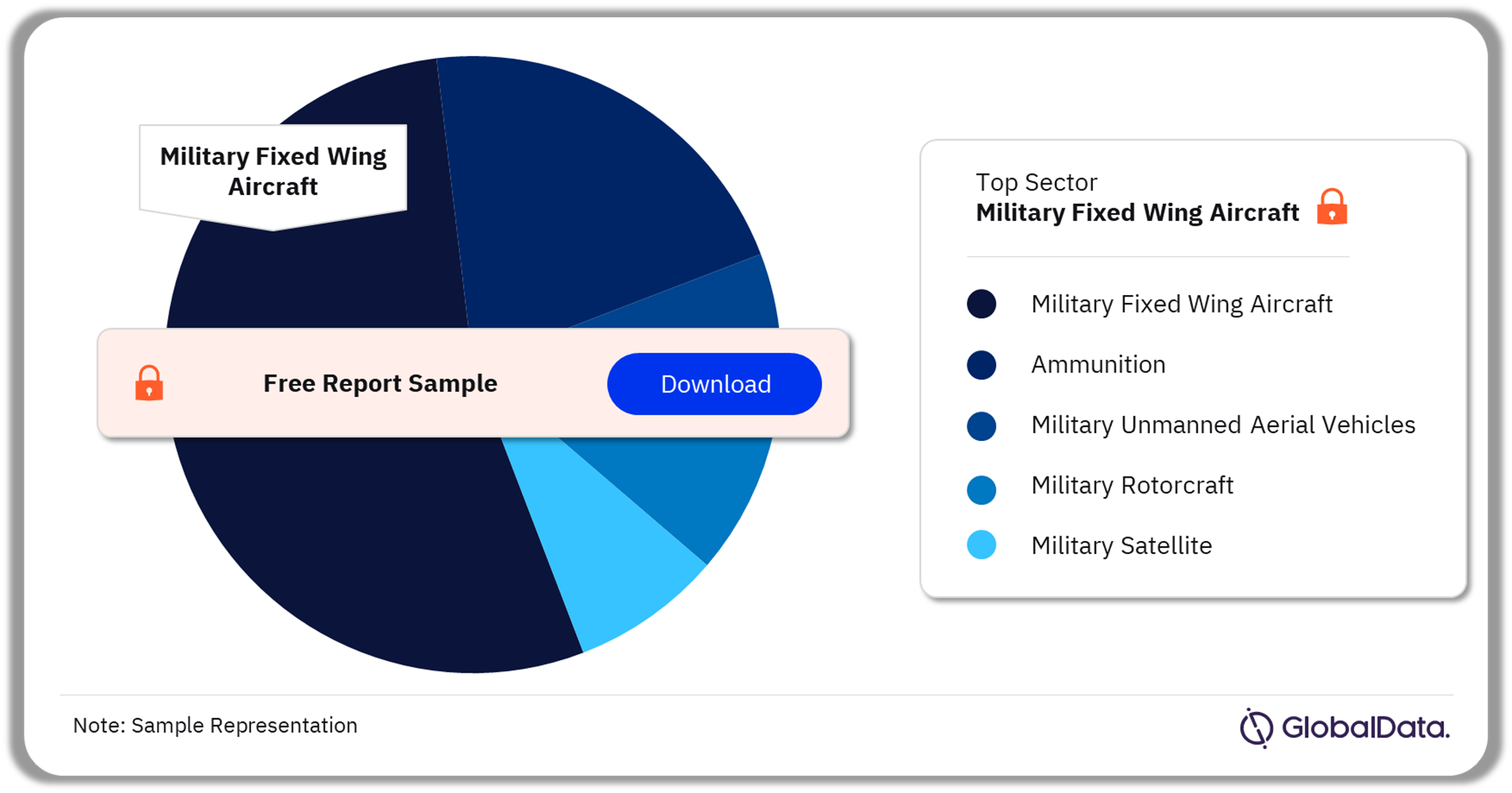

United Arab Emirates (UAE) Defense Market Segmentation by Sectors

The key sectors in the United Arab Emirates (UAE) defense market are military fixed-wing aircraft, ammunition, military unmanned aerial vehicles, military rotorcraft, and military satellites among others. In 2024, the military fixed-wing aircraft sector dominated the defense segments by value.

United Arab Emirates (UAE) Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the United Arab Emirates Defense Market

United Arab Emirates (UAE) Defense Market - Competitive Landscape

A few of the leading defense companies operating in the United Arab Emirates are:

- Saab

- BAE Systems

- Raytheon

- Rolls Royce

- Northrop Grumman

Saab is an international defense solutions company that serves military defense and civil security markets with its products, services, and solutions. The company offers electronic warfare, airborne solutions, the Gripen fighter system, and weapons systems in the air market. It provides C4I solutions, force projection, ground-based air defense, signature management, and support solutions in the land market.

United Arab Emirates (UAE) Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the United Arab Emirates Defense Market

Segments Covered in the Report

United Arab Emirates (UAE) Defense Market Sectors Outlook (Value, $ Billion, 2020-2029)

- Military Fixed Wing Aircraft

- Ammunition

- Military Unmanned Aerial Vehicles

- Military Rotorcraft

- Military Satellite

Scope

The report provides:

- Detailed analysis of the United Arab Emirates 2024 defense budget broken down into market size and market share.

- Overview of key current and future acquisitions.

- Explanation of the procurement policy and process.

- Analysis of the United Arab Emirates (UAE) military doctrine and strategy to provide a comprehensive overview of the United Arab Emirates (UAE) military procurement regulation.

- Outline of political alliances and perceived security threats to the United Arab Emirates (UAE) and trends in spending and modernization.

- Analysis of the competitive landscape and strategic insights of United Arab Emirates (UAE)’s defense industry.

Key Highlights

• Drivers of Defense expenditure include Modernization of the UAE Armed Forces, Counter-insurgency and anti-terrorism initiatives

• Major ongoing procurement program include procurement of Rafael fighter, IJAIS 6×6, Terminal High Altitude Area Defense (THAAD)

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the United Arab Emirates (UAE) defense market over the next five years.

- Understand the underlying factors driving demand for different defense and internal security segments in the United Arab Emirates (UAE) market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the United Arab Emirates (UAE) defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the United Arab Emirates (UAE) government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Table of Contents

Frequently asked questions

-

What is the UAE defense budget in 2024?

The UAE defense budget is estimated to be valued at $25 billion in 2024.

-

What will the UAE defense market growth rate be during the forecast period?

The defense market in the UAE is expected to achieve a CAGR of more than 4% during 2025-2029.

-

Which sector dominated the defense segments by value in the United Arab Emirates defense market in 2024?

The military fixed-wing aircraft sector dominated the defense segments by value in the United Arab Emirates defense market in 2024.

-

Which are the key companies operating in the United Arab Emirates defense market?

A few of the leading defense companies operating in the United Arab Emirates are Saab, BAE Systems, Raytheon, Rolls Royce, and Northrop Grumman among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports