Albania Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Albania Defense Market Report Overview

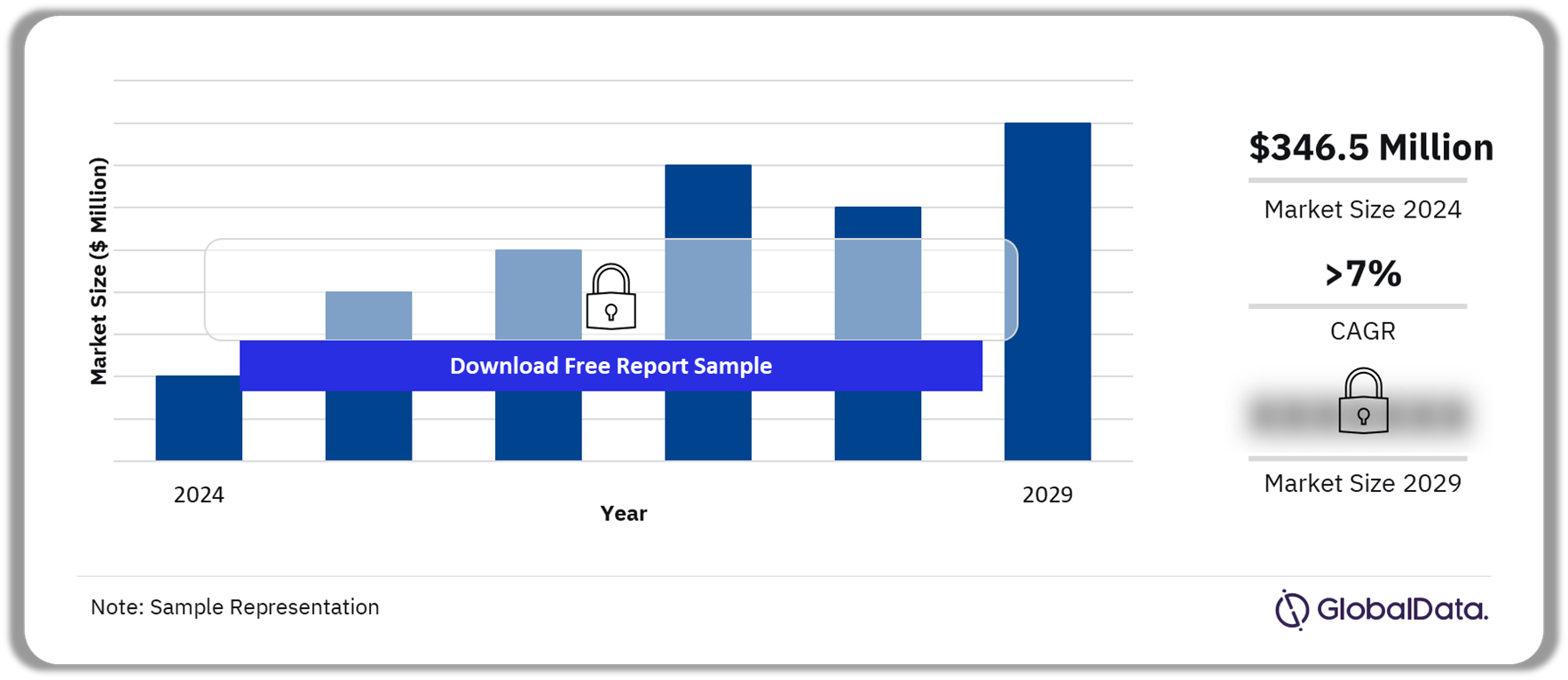

The Albania defense budget is valued at $346.5 million and is expected to grow at a CAGR of more than 7% during 2025-2029. The Russian invasion of Ukraine has spurred the country’s defense budget like many other European nations.

Albania Defense Market Outlook, 2024-2029 ($ Million)

Buy the Full Report for More Insights into the Albania Defense Market Forecast

The Albania defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Albania defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $346.5 million |

| CAGR (2025-2029) | >7% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Commitment to international operations and organizations

· Russian threats to Europe · Capability development and diversification |

| Key Sectors | · Military Unmanned Aerial Vehicles

· Tactical Communication Systems · EO/IR Systems · Military Simulation and Training · INS GNSS |

| Leading Companies | · Baykar Technologies

· Albcontrol Sha |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Albania Defense Market Drivers

The key factors driving Albania’s defense market growth are commitment to international operations and organizations, Russian threats to Europe, and capability development and diversification.

Commitment to international operations and organizations: Albania seeks the support of international organizations and multilateral security cooperation for its safety and prosperity. It also allocates a portion of military expenditure to the UN and NATO via shared facilities and personnel deployed on operations in Afghanistan, as well as bilaterally supporting US operations in Iraq.

Buy the Full Report for Additional Information on the Albania Defense Market Drivers

Albania Military Doctrines and Defense Strategies

Albania’s armed forces are primarily oriented toward self-defense and border protection, with little offensive capability, its navy performs mostly Coast Guard duties. Albania has a recent history of conflict and tension with Balkan neighbors, however, its accession to the NATO alliance in 2009 has afforded it the protection of collective defense. This is considered the cornerstone of all Albanian security and defense policy, and without this protection, Albania would need a major reassessment of its military capabilities.

Albania’s Army comprises a rapid reaction brigade, a smaller ‘Commando’ special forces regiment, and the ‘Area Support’ brigade. Together, they facilitate engineering, transport, logistics, medical and intelligence units, and other operations. The country also trains cadets at the Albanian Armed Forces Academy (AAFA), which, after the Cold War, was remodeled based on the curriculum of the US Military Academy of West Point. The AAFA has also hosted foreign military cadets, especially from Kosovo, and other Balkan nations, as well as some US National Guard officers. This modern facility has successfully brought Albanian military training standards and procedures to be more in line with NATO practices.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the Albania Defense Market

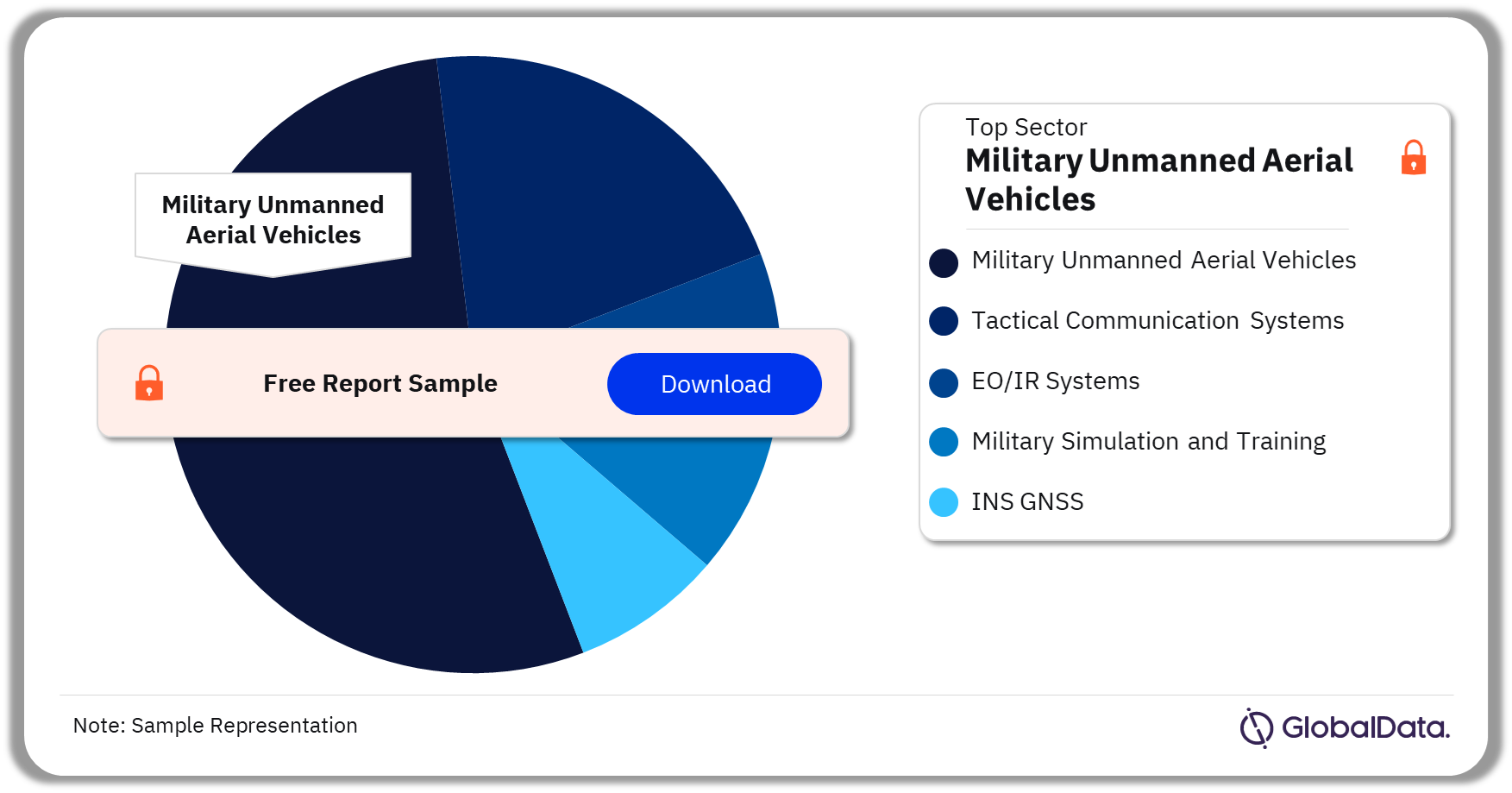

Albania Defense Market Segmentation by Sectors

The key sectors in the Albania defense market are military unmanned aerial vehicles, tactical communication systems, EO/IR systems, military simulation and training, and INS GNSS. In 2024, the leading sector in Albania’s defense market is military unmanned aerial vehicles, followed by tactical communication systems.

Albania Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Albania Defense Market

Albania Defense Market - Competitive Landscape

A few of the leading defense companies operating in Albania are:

- Baykar Technologies

- Albcontrol Sha

Baykar Technologies: Baykar Technologies (Baykar), headquartered in Istanbul, Turkey, is a manufacturer and supplier of electronic systems for military and commercial applications. The company’s product portfolio includes unmanned aerial vehicle systems; ground control stations for air operations; a central UAV management surveillance system, a web-based mapping tool that provides information about UAVs; simulator systems such as hardware cycle simulation and training simulators; subsystems; and payload systems. Its service offerings include inventory and spare parts management, repair and maintenance, training, logistics support, packaging, and technical support solutions. The company serves defense, armed forces, telecommunication, and aerospace sectors.

Albania Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the Albania Defense Market

Segments Covered in the Report

Albania Defense Market Sectors Outlook (Value, $ Million, 2020-2029)

- Military Unmanned Aerial Vehicles

- Tactical Communication Systems

- EO/IR Systems

- Military Simulation and Training

- INS GNSS

Scope

This report offers:

- A detailed analysis of the Albania 2024 defense budget broken down into market size and market share.

- An analysis of the factors that influence demand for the industry, key market trends, and challenges faced by industry participants.

- An explanation of the procurement policy and process.

- An analysis of Albania’s military doctrine and strategy to provide a comprehensive overview of Albania’s military procurement regulation.

- An outline of political alliances and perceived security threats to Albania and trends in spending and modernization.

- An analysis of the competitive landscape and strategic insights of Albania’s defense industry.

Key Highlights

- Albania’s defense expenditure recorded a CAGR of 15.16% between 2020 and 2024 and amounted to $346.5 million in 2024. Over the forecast period, Albania’s expenditure is expected to reach $512.8 million in 2029, growing at a CAGR of 7.69%. Despite the contracting population, Albania’s military modernization programs are not affected. It is expected to continue to invest in defense modernization and procurement plans. The acquisition budget is expected to grow from $111.5 million in 2025 to $173.2 million in 2029.

- Albania’s acquisition budget in 2024 is valued at $95.2 million, which is significant owing to the need to finance its ongoing procurement programs.

- The country has traditionally favored investments in developing a highly competent ground combat units. For this reason, Military land vehicles is the largest sector in the Albania defense market

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Albania defense market over the next five years.

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the Albania market and identify the opportunities offered.

- Understand the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats impacting the Albania defense market. Also, get a clear picture of future opportunities that can be tapped for revenue expansion.

- Focus on ongoing Albania government-initiated programs to channel resources.

- Make correct business decisions based on an in-depth analysis of the competitive landscape, which consists of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Baykar Technologies (Baykar)

Rheinmetall AG

Albcontrol Sha Private

Table of Contents

Frequently asked questions

-

What is the Albania defense market size in 2024?

The defense market size in Albania is $346.5 million in 2024.

-

What will the Albania defense market growth rate be during the forecast period?

The defense market in Albania is expected to achieve a CAGR of more than 7% during 2025-2029.

-

Which sector holds the highest share of the Albania defense market in 2024?

Military unmanned aerial vehicles accounted for the highest share in the Albania defense market in 2024.

-

Which are the key companies operating in the Albania defense market?

A few of the leading defense companies operating in Albania are Baykar Technologies and Albcontrol Sha.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports