Hungary Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2029

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hungary Defense Market Report Overview

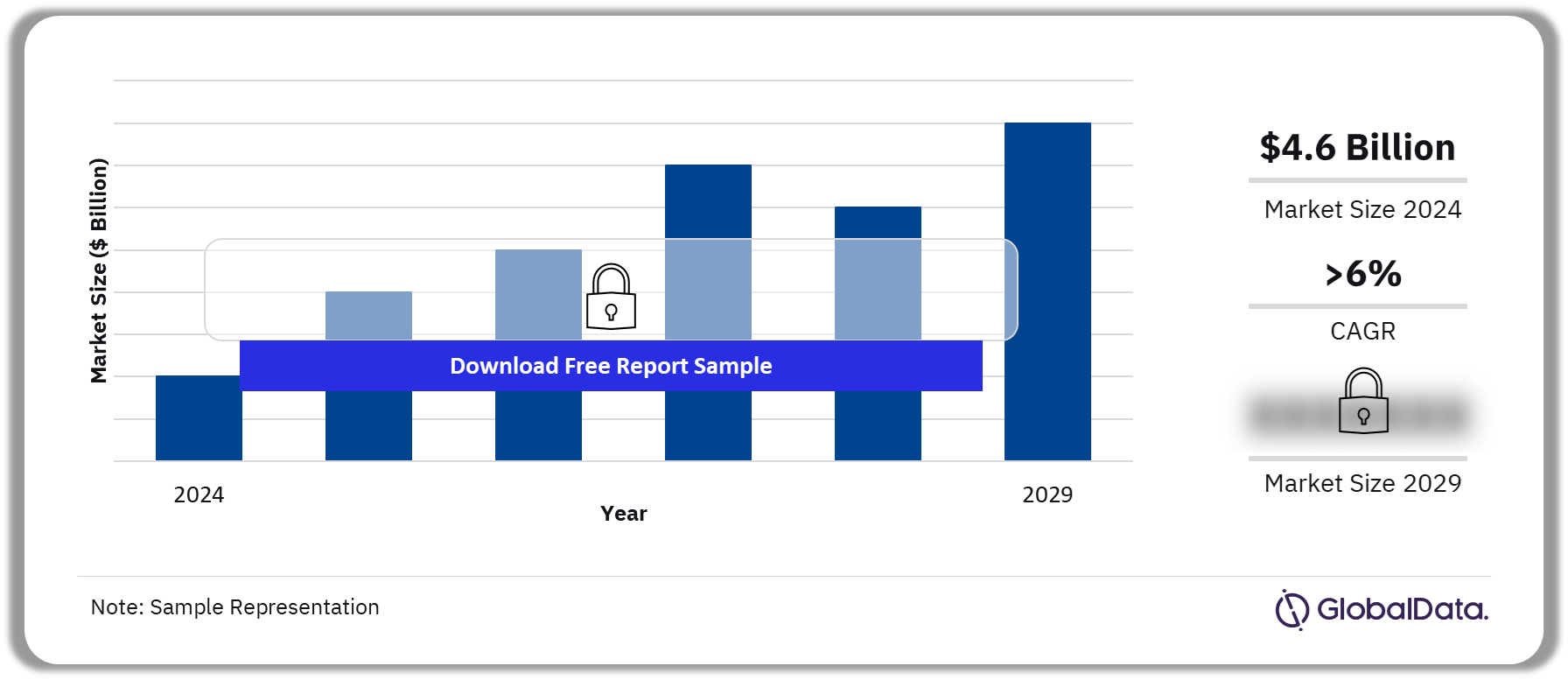

In 2024, Hungary’s defense budget is worth $4.6 billion. The country’s defense budget will grow at a CAGR of more than 6% during 2025-2029. The largest component of Hungary’s defense expenditure every year is acquisition. This is the result of the ongoing Zrínyi Modernization Program to update Hungary’s aging military equipment, much of which is still a holdover from the Soviet era.

Hungary Defense Market Outlook, 2024-2029 ($ Billion)

Buy the Full Report for More Insights into the Hungary Defense Market Forecast

The Hungary defense market research report provides the market size forecast and the projected growth rate for the next five years. Furthermore, our analysts have carried out a comprehensive industry analysis to determine key market drivers, emerging technology trends, key sectors, and major challenges faced by market participants, in this report. The Hungary defense market study has also assessed key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2024) | $4.6 billion |

| CAGR (2025-2029) | >6% |

| Forecast Period | 2025-2029 |

| Historical Period | 2020-2024 |

| Key Drivers | · Commitment to NATO Membership

· Military Modernization |

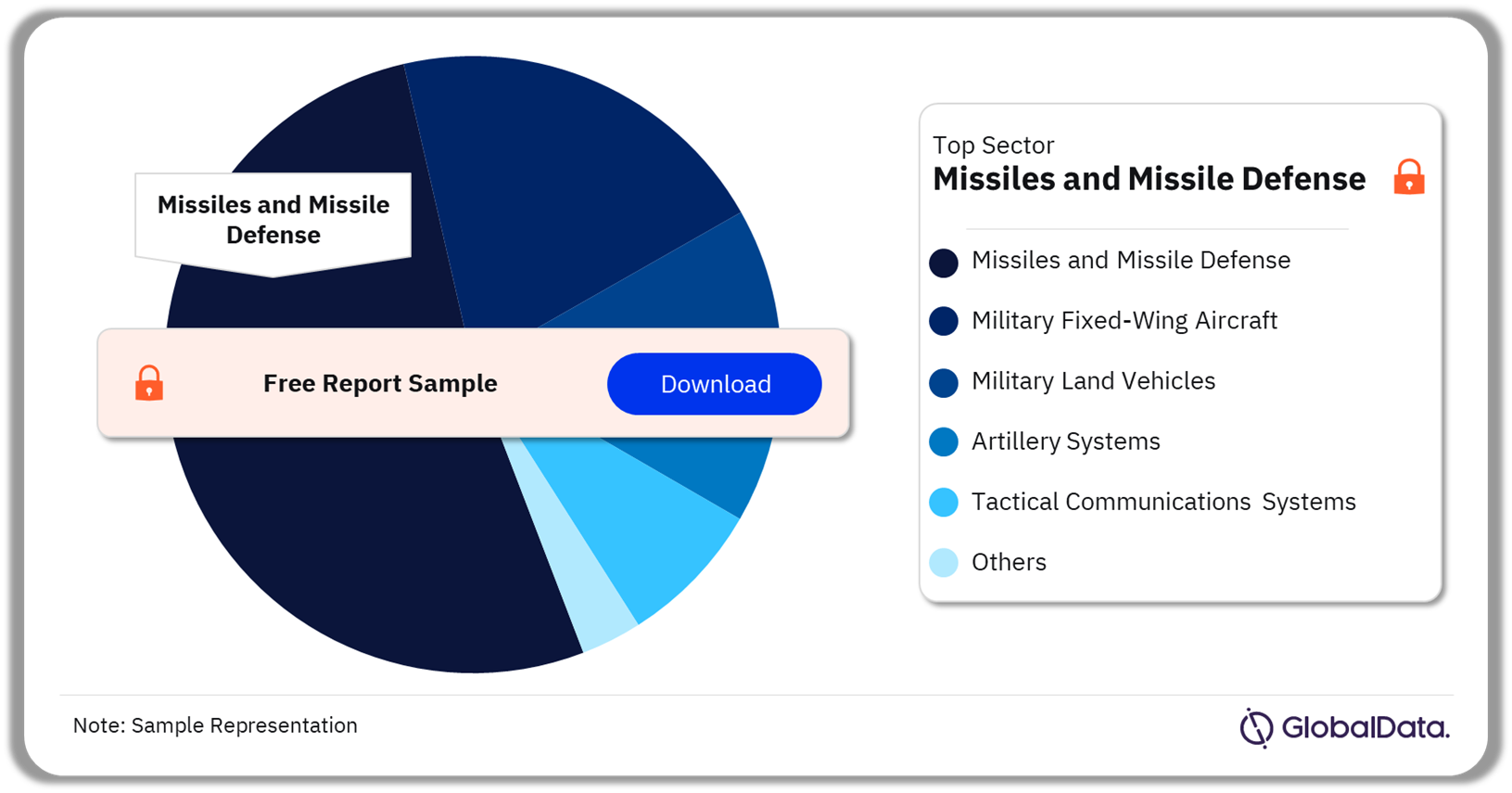

| Key Sectors | · Missiles and Missile Defense

· Military Fixed Wing Aircraft · Military Land Vehicles · Artillery Systems · Military Rotorcraft · Tactical Communication Systems |

| Leading Companies | · Raba Jarmuipari Holding Nyrt

· AerinX · Corvex Uzleti Megoldasok Zrt · Corvus Aircraft Kft · Dunai Repulogepgyar Zartkoruen Mukodo Reszvenytarsasag |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Hungary Defense Market Drivers

The key factors driving the Hungarian defense market growth are a commitment to NATO membership and military modernization.

Military modernization: The Hungarian government has set about a large acquisition program to modernize its fleet after recognizing that its old Soviet-era weapons and equipment are not up to the task of modern combat.

Buy the Full Report for More Information on Hungary’s Defense Market Drivers

Hungary Military Doctrines and Defense Strategies

Hungary’s most recent military strategy outlined in 2021 includes a plan to build a defense force fit for 21st-century warfare. The government announced the Zrínyi National Defense and Force Development Program previously called Zrínyi 2026. This was originally a 10-year military modernization plan but is now scheduled to be completed in 2030 due to its increased size and scope. The three key features of the plan include increasing defense spending, strengthening the domestic defense industry, and strengthening the capabilities of the armed forces.

Hungary’s 2021 update to its national strategy emphasizes building up the military industry, the renewal of the Hungarian Defense Forces, and defense cooperation with NATO and EU allies. These policies reflect how Hungary is seeking to develop its defense forces to become a significant military force in the Central Europe region by 2030.

Buy the Full Report for More Insights on the Military Doctrines and Defense Strategies in the Hungary Defense Market

Hungary Defense Market Segmentation by Sectors

The key sectors in the Hungary defense market are missiles and missile defense, military fixed-wing aircraft, military land vehicles, artillery systems, military rotorcraft, and tactical communication systems, among others. In 2024, the missiles and missile defense accounted for the highest share in the Hungarian defense market, followed by military fixed-wing aircraft.

Hungary Defense Market Analysis by Sectors, 2024 (%)

Buy the Full Report for More Sector Insights into the Hungary Defense Market

Hungary Defense Market - Competitive Landscape

A few of the leading defense companies operating in Hungary are:

- Raba Jarmuipari Holding Nyrt

- AerinX

- Corvex Uzleti Megoldasok Zrt

- Corvus Aircraft Kft

- Dunai Repulogepgyar Zartkoruen Mukodo Reszvenytarsasag

Raba Jarmuipari Holding Nyrt (Raba), headquartered in Gyor, Hungary, is a manufacturer and distributor of vehicles and automotive components. Its product portfolio comprises trucks, military vehicles, buses, seat parts, and armrest frames and covers, among others. Raba offers design, testing, machining, and assembly services. The company’s products are used in commercial vehicles, agricultural power plants, and earthmoving machines.

Hungary Defense Market Analysis by Companies

Buy the Full Report for More Company Insights into the Hungary Defense Market

Segments Covered in the Report

Hungary Defense Market Sectors Outlook (Value, $ Billion, 2020-2029)

- Missiles and Missile Defense

- Military Fixed Wing Aircraft

- Military Land Vehicles

- Artillery Systems

- Military Rotorcraft

- Tactical Communication Systems

Scope

The report provides:

- A detailed analysis of the Hungary 2024 defense budget broken down into market size and market share.

- An overview of key current and future acquisitions.

- An explanation of the procurement policy and process.

- An analysis of Hungary’s military doctrine and strategy to provide a comprehensive overview of Hungary’s military procurement regulation.

- An outline of political alliances and perceived security threats to Hungary and trends in spending and modernization.

- An analysis of the competitive landscape and strategic insights of Hungary’s defense industry.

Key Highlights

• Hungary’s defense expenditure recorded a CAGR of 13.52% between 2020 and 2024 and amounted to $4.59 billion in 2024. Over the forecast period, Hungary’s expenditure is expected to reach $6.10 billion in 2029, growing at a CAGR of 6.79%. Despite the contracting population, Hungary’s military modernization programs are not affected. It is expected to continue to invest in defense modernization and procurement plans. The acquisition budget is expected to grow from $2.24 billion in 2025 to $3.03 billion in 2029.

• Hungary’s acquisition budget in 2024 is valued at $2.19 billion, which is significant owing to the need to finance its ongoing procurement programs.

• The country has traditionally favored investments in developing a highly competent ground combat units. For this reason, Military land viechles is the largest sector in the Hungary defense market

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the Hungary defense market over the next five years.

- Gain in-depth understanding about the underlying factors driving demand for different defense and internal security segments in the Hungary market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Hungary defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Hungary government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Rheinmetall AG

Raba Jarmuipari Holding Nyrt

Aerinx

Corvus Aircraft Kft

GE Hungary Kft

Minister of Defense (Hungary)

Table of Contents

Frequently asked questions

-

What is the Hungary defense market size in 2024?

The defense market size in Hungary is $4.6 billion in 2024.

-

What will the Hungary defense market growth rate be during the forecast period?

The defense market in Hungary is expected to achieve a CAGR of more than 6% during 2025-2029.

-

Which sector holds the highest share of the Hungary defense market in 2024?

Missiles and missile defense holds the highest share of the Hungary defense market in 2024.

-

Which are the key companies operating in the Hungary defense market?

A few of the leading defense companies operating in Hungary are Raba Jarmuipari Holding Nyrt, AerinX, Corvex Uzleti Megoldasok Zrt, Corvus Aircraft Kft, and Dunai Repulogepgyar Zartkoruen Mukodo Reszvenytarsasag, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports