Spain Cards and Payments – Opportunities and Risks to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain Cards and Payments Market Report Overview

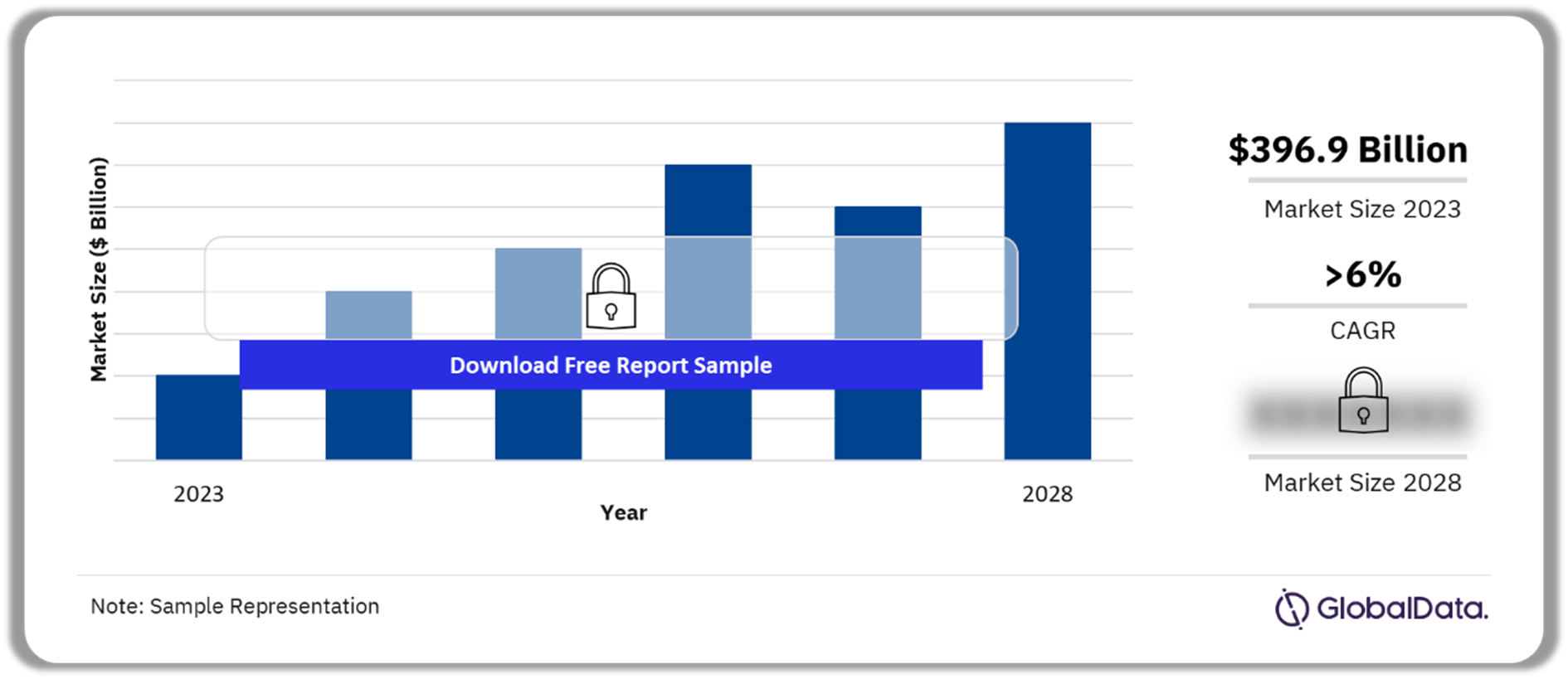

The annual value of card transactions in the Spain cards and payments market was $396.9 billion in 2023. The Spain cards and payments market will grow at a CAGR of more than 6% during 2024-2028. The payment infrastructure in Spain is experiencing growth owing to efforts from both the government and financial institutions. With a gradual rise in the number of customers using cards, there has been an increase in cashless transactions. This trend has initiated a growing demand for cost-efficient POS solutions, particularly mobile POS systems, especially among SMEs.

Spain Card Transactions Outlook, 2024-2028 ($ Billion)

Buy the Full Report for More Information on the Spain Cards and Payments Market Forecast Download a Free Sample Report

The Spain cards and payments market research report provides a detailed analysis of market trends influencing the industry. It provides transaction values and volumes for several payment instruments for the review period. In addition, the Spain cards and payments market analysis offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also entails regulatory policy details and provides extensive coverage of any recent changes in the regulatory structure.

| Annual Card Transactions Value (2023) | $396.9 Billion |

| CAGR (2024-2028) | >6% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Payment Instruments | · Cards

· Credit Transfers · Direct Debits · Cash · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments |

| Leading Players | · Santander

· CaixaBank · BNP Paribas · Bankinter · Banco Sabadell · BBVA Santander |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Spain Cards and Payments Market Dynamics

Cash remained the preferred method of payment in Spain in 2023e. However, efforts by banks to promote electronic payments has resulted in card payments gaining traction in 2023. The growing acceptance of payment cards by retailers and the advent of contactless technology is set to reduce the share of cash within the economy. Spanish merchants pivoted towards card payment acceptance, helped by increasing consumer use of mobile payment solutions such as Bizum, Apple Pay, and Google Pay.

QR code payments have been slow to take off in Spain. However, since QR code payments are cost-effective, merchants in Spain are increasingly offering this payment method, with brands such as Bizum offering QR code options for its users. In addition to payments at merchants, QR codes are also being utilized in Spain’s transportation network for ticket verification and payments. These advancements are expected to intensify competition, further accelerating Spain’s digital payments landscape.

Buy the Full Report to Get Additional Spain Cards and Payments Market Dynamics

Spain Cards and Payments Market Segmentation by Payment Instruments

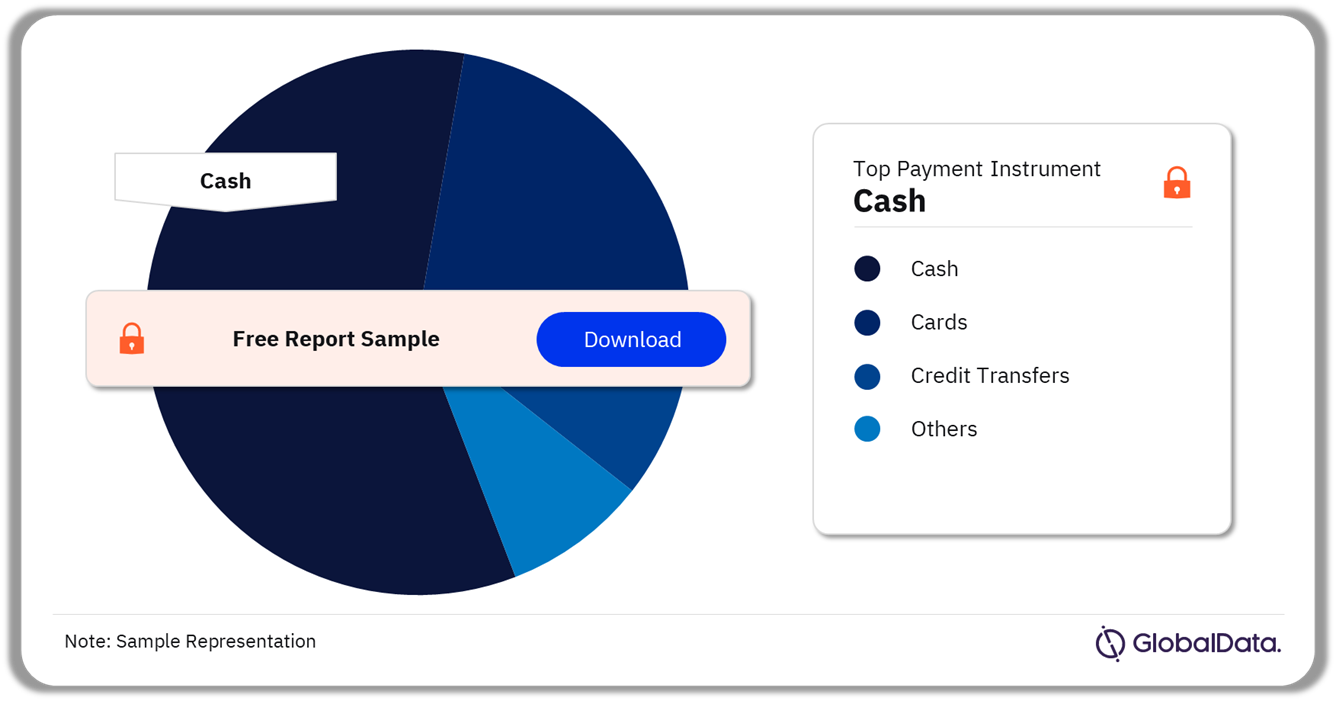

Cash had the highest transaction volume in the Spain payments space in 2023

The key payment instruments in the Spain cards and payments market are cards, credit transfers, direct debits, cash, and cheques. Although cash is currently the preferred payment method in Spain, it is steadily losing ground to card payments, which will surpass cash during the forecast period. The growing preference for electronic payments, especially by the younger generation, and the improving payment infrastructure will drive the electronic payments market growth.

Spain Cards and Payments Market Analysis by Payment Instruments (Volume Terms), 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Spain Cards and Payments Market

Spain Cards and Payments Market Segments

The key segments in the Spain cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, and mobile payments among others.

Card-Based Payments: The Spain payment card market will grow due to the rising consumer preference for electronic payments. This trend has become more prevalent with banks and merchants urging consumers to use non-cash payment methods. Card penetration in Spain stood at more than 1 card per individual in 2023e. With the increased adoption of mobile wallets, expanding payments infrastructure, rising digitalization of payments, and the growing e-commerce market, electronic payments are anticipated to further displace cash transactions.

Buy the Full Report for More Market Segment Insights into the Spain Cards and Payments Market

Spain Cards and Payments Market - Competitive Landscape

A few of the leading players in the Spain cards and payments market are Santander, CaixaBank, BNP Paribas, Bankinter, Banco Sabadell, and BBVA among others.

Spain Cards and Payments Market Analysis by Players, 2023

Buy the Full Report to Know More about the Players in the Spain Cards and Payments Market

Spain Cards and Payments Market – Latest Developments

- In May 2023, Spain’s CaixaBank introduced a contactless app designed to enable merchants to accept payments via cards and QR codes.

- CaixaBank launched a contactless app in May 2023, enabling merchants to accept card payments via smartphones. This app transforms Android handsets into POS devices, facilitating card payments via QR codes or email anywhere.

Segments Covered in the Report

Spain Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2028)

- Cards

- Credit Transfers

- Direct Debits

- Cash

- Check

Spain Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2028)

- Card-Based Payments

- Merchant Acquiring

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

• The payment infrastructure in Spain is experiencing growth, bolstered by efforts from both the government and financial institutions. With a gradual rise in the number of customers using cards, there has been an increase in cashless transactions. This trend has initiated growing demand for cost-efficient POS solutions, particularly mobile POS systems, especially among SMEs. As a result, banks are extending their services to a wider range of merchants. For instance, in May 2023, Spain’s CaixaBank introduced a contactless app designed to enable merchants to accept payments via cards and QR codes.

• QR code payments have been slow to take off in Spain. However, since QR code payments are cost effective, merchants in Spain are increasingly offering this payment method, with brands like Bizum offering QR code options for its users. Additionally, CaixaBank launched a contactless app in May 2023, enabling merchants to accept card payments via smartphones. This app transforms Android handsets into POS devices, facilitating card payments via QR codes or email anywhere. In addition to payments at merchants, QR codes are also being utilized in Spain’s transportation network for ticket verification and payments. These advancements are expected to intensify competition, further accelerating Spain’s digital payments landscape.

• To mitigate incidences of card fraud, banks and payment companies are prioritizing the security of card payments. In April 2023, Spain became the first European country to officially embrace fingerprint-activated biometric credit and debit cards. Starting from 2024, banks plan to issue new cards that will have a fingerprint scanner. The system works in combination with a chip to confirm the user’s identity during a transaction. Mastercard communicated its intent to lead this transition, aiming to bolster security and prevent card fraud.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Spain cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Spain cards and payments industry.

- Assess the competitive dynamics in the Spain cards and payments industry.

- Gain insights into marketing strategies used for various card types in Spain.

- Gain insights into key regulations governing the Spain cards and payments industry.

CaixaBank

BNP Paribas

Bankinter

Banco Sabadell

BBVA

Santander

EVO Payments

Bankia

Sistemapay

Table of Contents

Frequently asked questions

-

What was the annual value of card transactions in the Spain cards and payments market in 2023?

The annual value of card transactions in the Spain cards and payments market was $396.9 billion in 2023.

-

What will the Spain cards market growth rate be during the forecast period?

The Spain annual cards market value will grow at a CAGR of more than 6% during 2024-2028.

-

Which was the leading payment instrument in the Spain cards and payments market in 2023?

Cash was the leading payment instrument in terms of transaction volume in the Spain cards and payments market in 2023.

-

Which are the leading players in the Spain cards and payments market?

A few of the leading players in the Spain cards and payments market are Santander, CaixaBank, BNP Paribas, Bankinter, Banco Sabadell, and BBVA among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports