United Kingdom (UK) Pet Insurance Distribution Dynamics by Channels and Future Market, 2023 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Pet Insurance Market Report Overview

In 2023, less than 40% of all customers renewed their policies with their existing provider. Customers preferred to renew policies for both dog and cat insurance. This year the proportions of customers who shopped around for dog and cat insurance grew by more than 1 pp compared to 2022.

The United Kingdom (UK) Pet Insurance Distribution Dynamics by Channels and Future Market report explores how purchasing preferences have changed over time. It reveals the most popular providers in the market and their increase in shares. Furthermore, new trends and innovations are highlighted, as well as the key factors that will influence the market over the next few years.

| Channels | · Affinity

· Broker · Bank · Insurer · OCW · Others |

| Leading Providers | · Petplan

· Animal Friends · Tesco Bank · ManyPets · Aviva |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for More Insights into the UK Pet insurance Market

A few of the key trends shaping the UK pet insurance market are the shortage of vets, increasing use of technology, and focus on product development among others.

Product development: In May 2023, PetPartners launched OnePack, an employer-based group pet insurance offering. The OnePack plan provides employers with a unique and simplified approach to offering pet insurance as part of their employee benefits packages. This innovative plan operates under the “One Group, One Policy, One Rate” model, which means that the employer becomes the master policyholder, offering a single rate for all participating employees.

Buy the Full Report for More Insights into the UK Pet insurance Market Trends

UK Pet Insurance Market - Channels

A few of the leading channels in the UK pet insurance market are affinity, broker, bank, insurer, OCW, and others. Online methods dominated pet insurance purchases across most channels. Online via a PC/laptop is the most popular way to purchase both dog and cat insurance in the UK.

In 2023, switching insurers was most common among customers who purchased via a PCW. PCWs regularly offer rewards for using their site to switch providers or buy a new policy. Moreover, the cost-of-living crisis and high inflation in the UK have made price an even more important factor for many customers.

UK Pet Insurance Market Analysis by Channels, 2022 (%)

Buy the Full Report for More Insights into the UK Pet insurance Market Channels

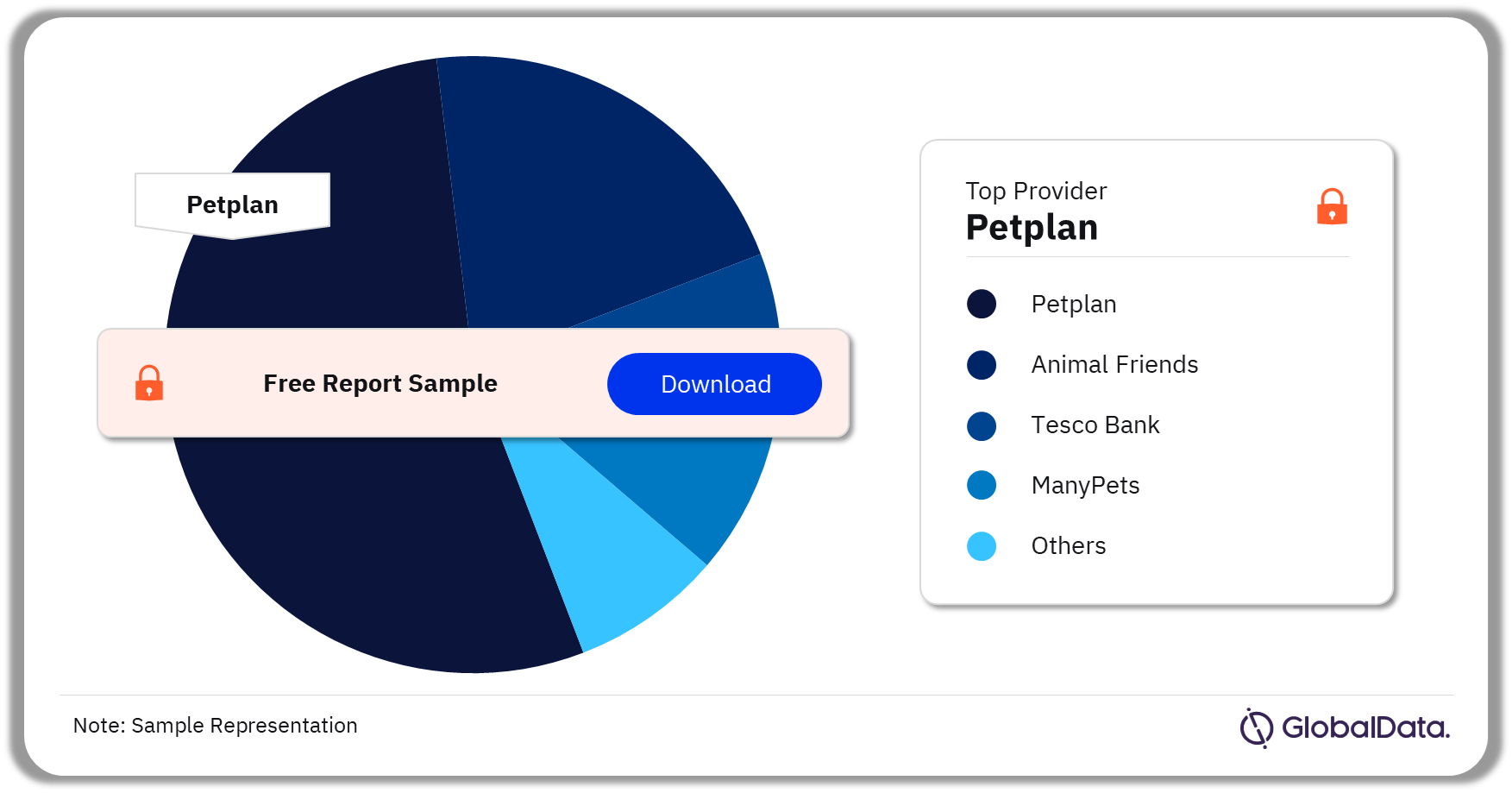

UK Pet Insurance Market - Competitive Landscape

A few of the leading providers in the UK pet insurance market are:

- Petplan

- Animal Friends

- Tesco Bank

- ManyPets

- Aviva

In 2023, the top 10 providers accounted for more than 74% of the market. Petplan was the largest provider, and its market share increased significantly compared to 2022. It has a strong presence in the market and is an established subsidiary of Allianz. Petplan offers three distinct lifetime policies (Classic, Classic+, and Ultimate), each offering varying degrees of coverage.

UK Pet Insurance Market Analysis by Providers, 2022 (%)

Buy the Full Report for More Insights into the UK Pet insurance Market Providers

Scope

- This report explores how purchasing preferences have changed over time in the UK pet insurance market.

- The report elaborates on what is most influential to customers when purchasing a pet insurance policy and reveals the most popular providers in the market.

- New trends and innovations are highlighted in the report, as well as the key factors that will influence the market over the next few years.

Key Highlights

- In 2023, Petplan and Animal Friends registered double-digit market shares.

- The top 10 providers accounted for more than 74% of the market.

- Direct Line was the only new entry to the top 10 for cat insurance in 2023, although there were changes in the positions of the other providers. Tesco Bank recorded the largest market share increase among the top 10 cat insurance providers.

Reasons to Buy

- Understand consumer purchasing decisions and how these will influence the market over the next few years.

- Improve customer engagement by recognizing what is most important to them and how insurers can adapt their products and services to meet their needs.

- Compare the Net Promoter Scores of key insurance providers.

- Discover which providers lead the way in the pet insurance space and learn about new product innovations.

- Adapt your distribution strategy to ensure it still meets customer purchasing behavior.

Petplan

ManyPets

Direct Line

Churchchill

Pets at Home

Aviva

Sainsbury

Tesco Bank

Admiral

Costco

Argos

Asda

RSA

Compare the Market

MoneySuperMarket

Go.Compare

Confused.com

PetPartners

Tractive

CRIF

Table of Contents

Frequently asked questions

-

How much did the proportion of customers for dog and cat insurance grew in 2023 compared to 2022?

In 2023, the proportion of customers who shopped around for dog and cat insurance grew by more than 1 pp compared to 2022.

-

What are the key channels in the UK pet insurance market?

The key pet insurance channels in the UK pet insurance market include affinity, broker, bank, insurer, OCW, and others.

-

Which are the key providers in the UK pet insurance market?

A few of the leading providers in the UK pet insurance market are, Petplan, Animal Friends, Tesco Bank, ManyPets, and Aviva.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pet reports