Automotive Sensors Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Sensors Market Report Overview

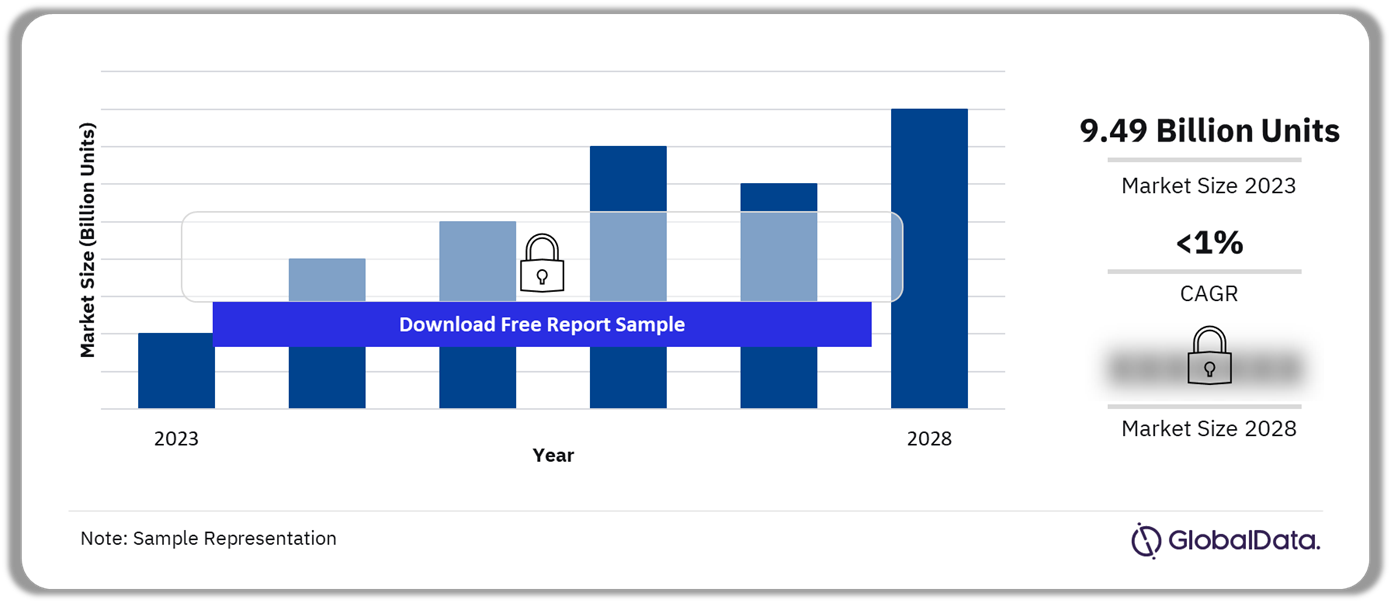

The automotive sensors market size was 9.49 billion units in 2023. The market will grow at a CAGR of less than 1% during 2023-2028. The growing integration of ADAS features in commercial vehicles is driving an increased demand for sensors. In 2023, Asia-Pacific accounted for a significant share of the market.

Automotive Sensors Market Outlook, 2023-2028 (Billion Units)

Buy the Full Report for More Insights into the Automotive Sensors Market

The automotive sensors market research report provides a comprehensive overview of the automotive sensors market trends and drivers. The report also provides a detailed overview of technological developments and innovations, PESTER analysis, and leading component suppliers at a global and regional level. Furthermore, evaluate strategic initiatives taken by market players and their recent product innovations to identify growth opportunities. The report also provides an overview of patent filings in the sector across regions, countries, and top applicants.

| Market Size (2023) | 9.49 billion units |

| CAGR (2023-2028) | <1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2028 |

| Key Regions | Asia-Pacific, Europe, North America, South America, and MEA |

| Key Companies | Continental, Magna, ZF TRW, Gentex, and Valeo |

| Key Sectors | Sensors-Safety and Body Control, Sensors-Powertrain & Emission Control, Sensors-Interior Technologies, and Sensors-ESC |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Sensors Market Trends

Developments in ADAS software are becoming more competitive in the sector as numerous sensors, ECUs, and actuators are present in EVs and autonomous vehicles. It helps incorporate a diverse range of features to monitor driver safety. Automakers are also researching and developing advanced safety and driver assistance systems to protect the passengers inside the vehicle from collision.

Buy the Full Report for More Trend Insights into the Automotive Sensors Market

Automotive Sensors Market Segmentation by Regions

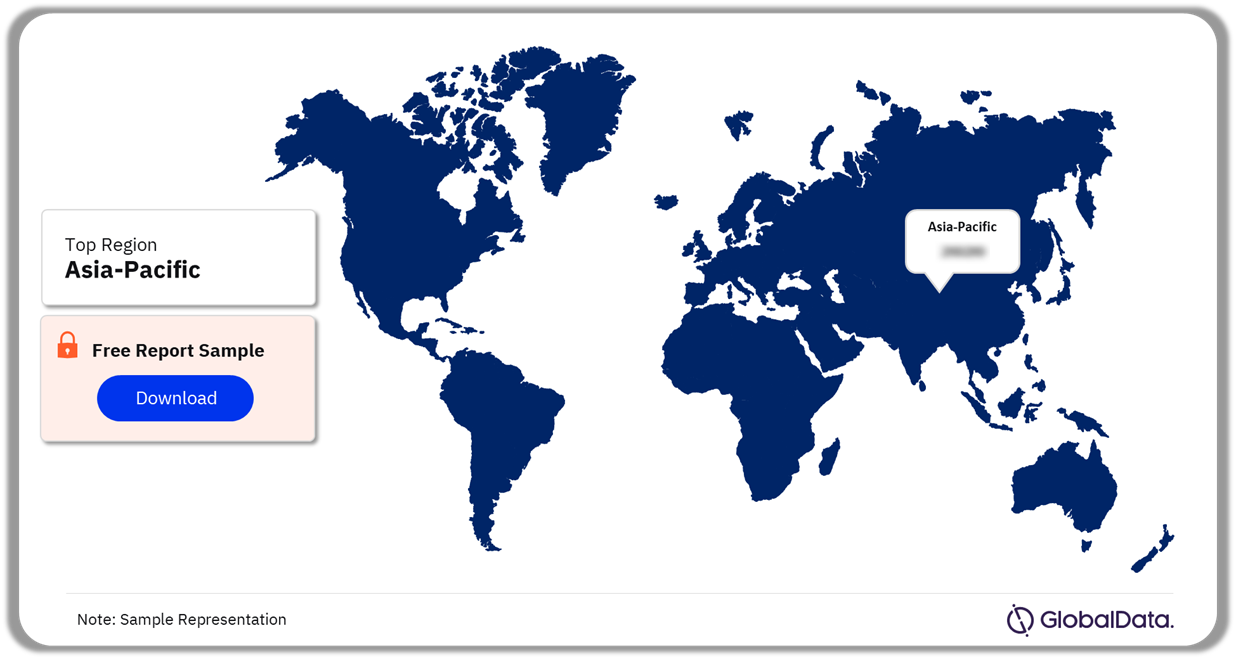

In 2023, Asia-Pacific accounted for the highest share among all the regions

The key regions in the automotive sensors market are Asia-Pacific, Europe, North America, South America, and MEA. Asia Pacific countries, especially China, Japan, and South Korea stand out as a crucial market for automotive sensors due to robust automotive industries and substantial investments in sensor technology research. The region has an increased demand for safety sensors, particularly in advanced driver assistance systems (ADAS), contributing to improved vehicle safety and reduced accidents.

Automotive Sensors Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Automotive Sensors Market

Automotive Sensors Market - Competitive Landscape

A few of the top companies operating in the market are:

- Continental

- Magna

- ZF TRW

- Gentex

- Valeo

The line of vehicle camera systems from Continental has been expanded. The new Platform AHD (Analog High Definition) Camera Systems from Continental are intended to enhance driver visibility and boost fleet productivity.

In July 2023, the Conti Urban bus tire, renowned for its adept handling of urban traffic demands, is evolving into a smart solution. Continental is now equipping the entire tire family with the latest-generation sensors straight from the factory.

Sensing Cameras Market Analysis by Companies

Buy the Full Report to Know More about Major Developments and Strategic Actions of Automotive Sensors Market Companies

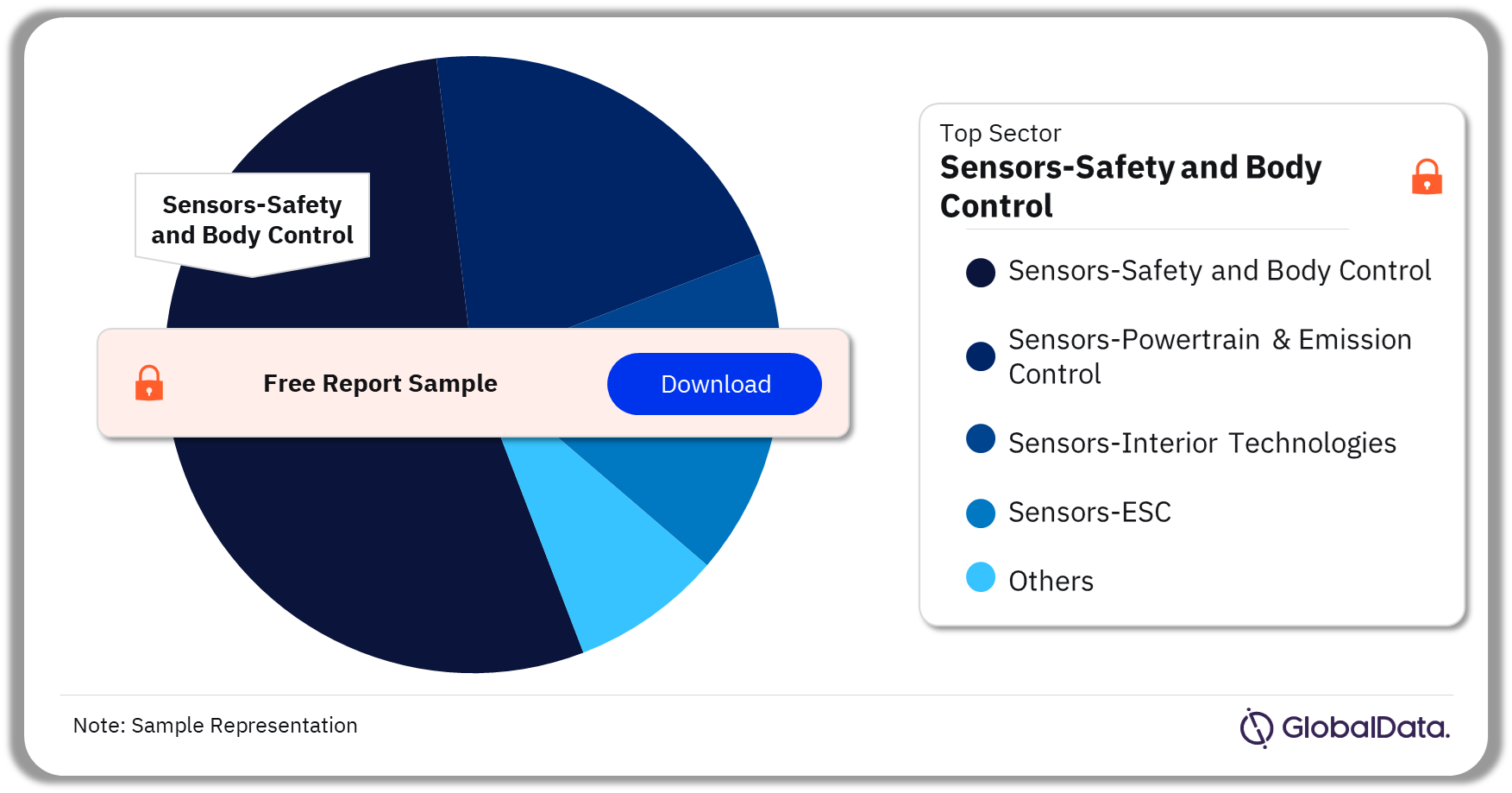

Automotive Sensors Market Segmentation by Sectors

The key sectors in the automotive sensors market are sensors-safety and body control, sensors-powertrain & emission control, sensors-interior technologies, sensors-ESC, and others. In 2023, sensors-safety and body control was the dominant sector in the market.

Automotive Sensors Market Analysis by Sectors, 2023 (%)

Buy the Full Report for More Sector Insights into the Automotive Sensors Market

Automotive Sensors Market - Latest Developments

A few of the latest developments in the automotive sensors market are as follows:

- In 2024, Remsons Industries Ltd., a prominent participant in the Automotive Industry’s Cables & Shifters sector, has revealed a significant deal to obtain a controlling interest in Uni-Automation’s Automotive Sensor Division, a renowned sensor technology company.

- In 2024, Schaeffler AG (“Schaeffler”) has agreed with BofA Securities Europe S.A. to purchase 3.6 mn shares in Vitesco Technologies Group AG (“Vitesco”), representing a total stake of approximately 9.00 percent in Vitesco.

Buy the Full Report to Know More about the Latest Developments in the Automotive Sensors Market

Segments Covered in the Report

Automotive Sensors Sector Outlook (Value, Billion Units, 2018-2028)

- Sensors-Safety and Body Control

- Sensors-Powertrain & Emission Control

- Sensors-Interior Technologies

- Sensors-ESC

Automotive Sensors Regional Outlook (Value, Billion Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global sensors sector. It includes an analysis of the following:

Trends & Drivers: Provides an overview of the current sector scenario regarding the future outlook in terms of key trends and drivers of the sector.

Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

PESTER Analysis: Provides a detailed understanding of various factors such as political, economic, social, technological, environmental, and regulatory impacting the sector.

Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2018–2028, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions-Asia-Pacific, Europe, MEA, North America, and South America -highlighting sector size, and growth drivers for the region.

Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

Auto OEMs and component suppliers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail. This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region. The report provides a detailed analysis of the regions and competitive landscape that can help companies gain insight into the region-specific nuances. The analysts have also placed a significant emphasis on the key trends that drive customer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion. To gain competitive intelligence about leading component suppliers in the sector in the region with information about their market share and growth rates.

Magna

Gentex

Denso

ZF

Valeo

Bosch.

Table of Contents

Table

Frequently asked questions

-

What was the automotive sensors market size in 2023?

The automotive sensors market size was 9.49 billion units in 2023.

-

What will the growth rate of the automotive sensors market be during the forecast period?

The automotive sensors market is expected to record a CAGR of less than 1% during 2023-2028.

-

Which was the leading sector in the automotive sensors market in 2023?

Sensors-safety and body control was the leading sector in the automotive sensors market in 2023.

-

Which was the leading region in the automotive sensors market in 2023?

Asia-Pacific was the leading region in the automotive sensors market in 2023.

-

Which are the key companies operating in the automotive sensors market?

The key companies operating in the automotive sensors market are Continental, Magna, ZF TRW, Gentex, and Valeo.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.