Hydrogen Transition Market Outlook and Trends, Deals, Contracts, Policies, Projects and Key Players, Q2 2024

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hydrogen Transition Market Report Overview

The total active and pipeline capacity of low-carbon hydrogen projects is 204 mtpa as of March 2024, of which 92% comes from green plants and the remaining from blue plants. Many regions of the world with ample renewable resources are pursuing large-scale green hydrogen projects to capitalize on the falling cost of producing renewable energy.

Furthermore, the pipeline of upcoming green projects represents 1,374 GW of electrolyzer capacity, while upcoming blue projects would incorporate over 106 million tonnes of CCS capacity.

The hydrogen transition market research report offers a detailed hydrogen market analysis in Q2 2024. The report outlines total upcoming capacity and 2030 market size scenarios, highlighting recently announced projects by capacity. The report also offers insights into the deals and contracts scenario for hydrogen across different application sectors with global policy support and financial incentives.

| Total Active and Pipeline Capacity (March 2024) | 204 mtpa |

| Key Hydrogen Plants | · GHI Spirit of Scotia Hydrogen Hub Project

· GHI Fleur-de-lys Green Hydrogen Hub Project · GreenGo Megaton Moon Hydrogen Complex · Western Green Energy Hydrogen Plant · Adani New Industries (ANIL) Mundra Hydrogen Project Phase 2 |

| Key Countries | · Canada

· Mauritania · Australia · India · The US · Egypt |

| Key Deals | · Mergers & Acquisitions (M&A)

· Venture Finance · Partnerships |

| Leading Companies | · Green Hydrogen International

· GreenGo Energy Group A/S · Adani Enterprises Ltd · ACME Cleantech Solutions Pvt Ltd · BP Plc · British International Investment plc |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for More Insights into the Hydrogen Transition Market

Hydrogen Transition Market Segmentation by Plants

The key plants having the highest hydrogen plant capacity are GHI Spirit of Scotia Hydrogen Hub Project, GHI Fleur-de-lys Green Hydrogen Hub Project, GreenGo Megaton Moon Hydrogen Complex

Western Green Energy Hydrogen Plant, Adani New Industries (ANIL) Mundra Hydrogen, and Project Phase 2 among others.

Buy the Full Report for More Project Insights into the Hydrogen Transition Market

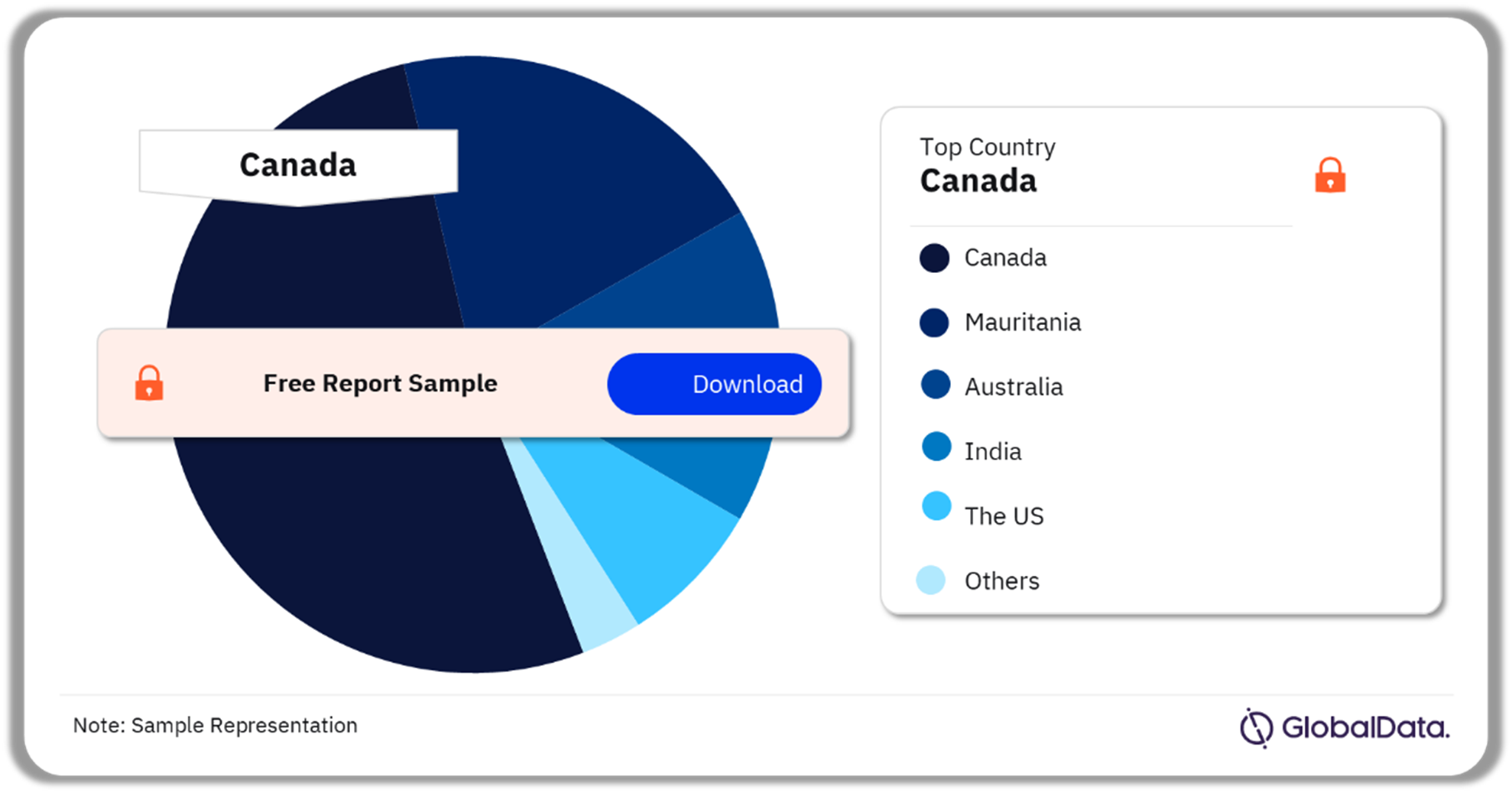

Hydrogen Transition Market Segmentation by Countries

The key countries having the highest cumulative hydrogen capacity are Canada, Mauritania, Australia, India, The US, and Egypt. Canada leads in terms of capacity by a large margin, with over 90 mtpa across 77 different hydrogen hubs. Australia follows with 196 projects and almost 13 mtpa capacity.

Hydrogen Transition Market Analysis by Countries, Q1 2024 (%)

Buy the Full Report for More Country-Level Insights into the Hydrogen Transition Market, Download A Free Report Sample

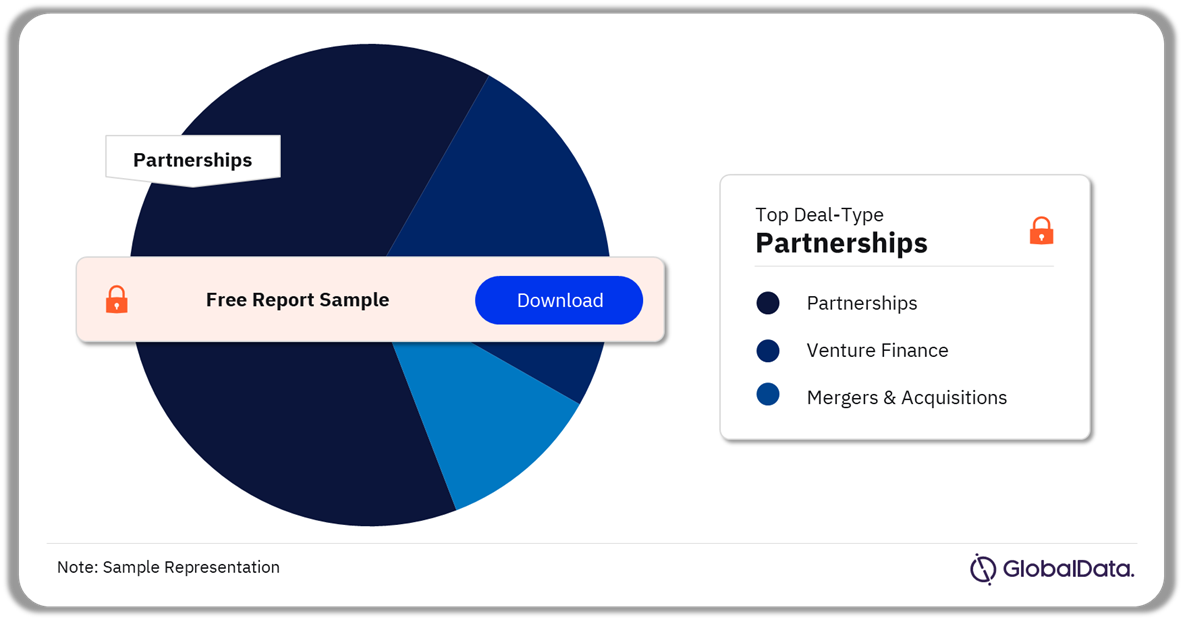

Hydrogen Transition Market Segmentation by Deals

Deals can be a useful benchmark for emerging markets like hydrogen. The overall value of hydrogen deals continued to be low due to a low deal count. In terms of deal volume, hydrogen deal values demonstrated a decline from the prior year. On the other hand, deal values generally recovered, especially for M&A.

Hydrogen Transition Market Analysis by Deals, Q1 2024 (%)

Buy the Full Report for more Insights into the Hydrogen Transition Market Deal Types

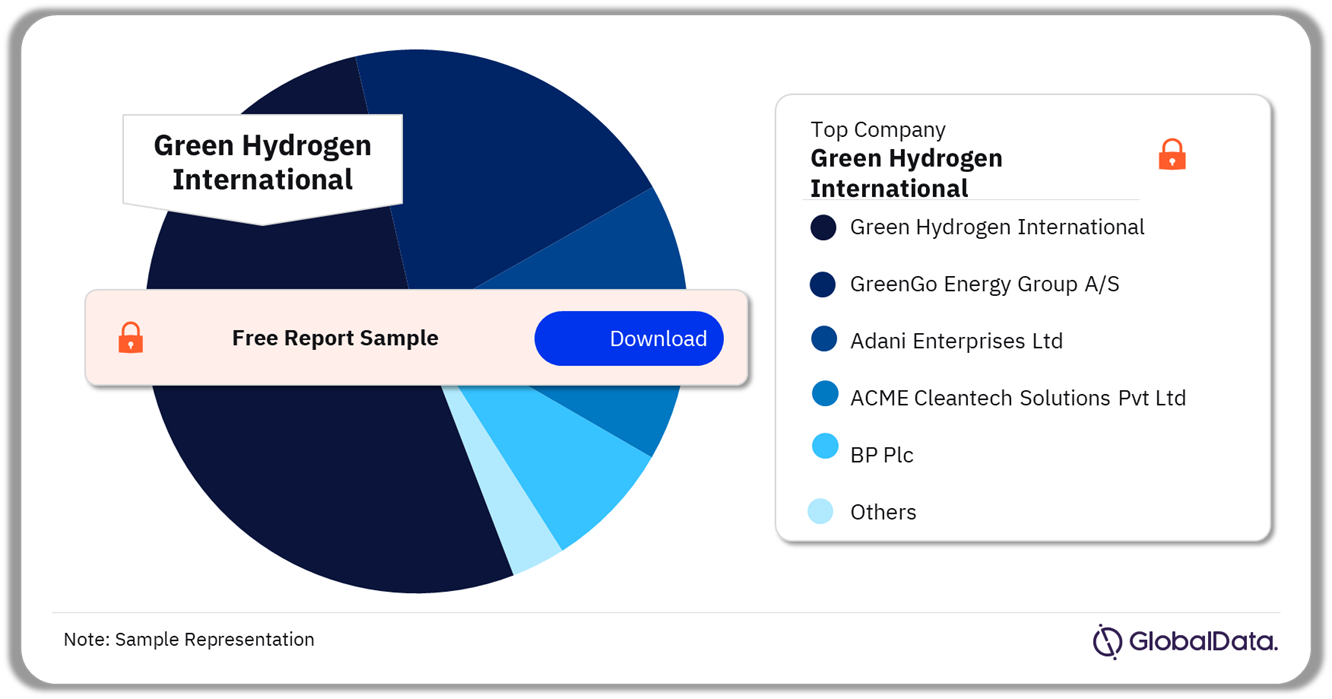

Hydrogen Transition Market – Competitive Landscape

Companies’ net capacities have been calculated based on their participation share across all projects. The low-carbon hydrogen economy is gaining traction in the industry, which is attracting a wider spectrum of participants to projects. Engaging in numerous, usually minor projects dispersed throughout several areas is an additional tactic.

A few leading companies in the hydrogen transition market are Green Hydrogen International, Green Go Energy Group A/S, Adani Enterprises Ltd, ACME Cleantech Solutions Pvt Ltd, BP Plc, and British International Investment Plc among others. Green Hydrogen International continues to have the highest amount of proposed capacity with 87 mtpa related to two projects in Canada.

Hydrogen Transition Market Analysis by Companies, Q1 2024 (%)

Buy the Full Report to Know More About the Leading Companies in the Hydrogen Transition Market

Segments Covered in the Report

Hydrogen Transition Country-Level Outlook (mtpa, Q2 2024)

- Canada

- Mauritania

- Australia

- India

- The US

- Egypt

Hydrogen Transition Deals Outlook (2022 -2024)

- Mergers & Acquisitions (M&A)

- Venture Finance

- Partnerships

Scope

The report provides:

- Hydrogen quarterly changes, Q4 2023.

- Total upcoming capacity and 2030 market size scenarios, highlighting recently announced projects by capacity, countries, and regions.

- Trends over deals, partnerships, and M&A.

- Global policy support and financial incentives.

Key Highlights

In Q1 2024, 7 countries announced new low carbon hydrogen plants, with 3 countries also indicating the capacity of the projects. India was the chief contributor to announced capacity, adding 320ktpa across the quarter. As a result, India now ranks fifth globally in terms of active and upcoming capacity.

This quarter announced capacity showed a strong increase from the previous quarter, where 141ktpa of capacity was announced. However, project announcements have still significantly slowed when compared to Q1 2023, where 3.9mtpa of capacity was announced.

Reasons to Buy

- Identify the last market trends by quarter and key players in hydrogen technologies.

- Develop market insight of current, in development, and announced capacity and latest trends of the sector.

- Understand the different scenarios for 2030 based on the likeliness of the projects.

- Facilitate the understanding of how and where the market is growing as it is rapidly scaling up to position as one of the main topics of the international agenda.

Adani Enterprises Ltd

GreenGo Energy Group A/S

CWP Global

Future Industries Pty Ltd

Jearrard Energy Resources Ltd

BP Plc

TotalEnergies SE

Shell plc

Intercontinental Energy Corp

Air Products and Chemicals Inc

Eren Groupe SA

Solatio Energia

Copenhagen Infrastructure Partners KS

Inpex Corp

Mining Green Energy Ltd

Mitsubishi HC Capital Inc

European Energy AS

Hyundai Motor Co

FDE AS

Greenstat AS

Scottish Enterprise

Lanxing New Energy

Logan Energy Ltd

Honda Motor Co Ltd

Emerald Technology Ventures AG

Samsung Venture Investment Co

MPC Munchmeyer Petersen Capital AG

High-¬Tech Grunderfonds GmbH

Swen Capital Partners SA

GM Venture Capital

Barclays Sustainable Impact Capital

UK Infrastructure Bank

Siemens Energy Ventures

GL Ventures LLC

Sunfire GmbH

INERATEC GmbH

GeoPura Ltd

Beijing Mingyang Hydrogen Technology Co Ltd

Toyota Motor Corp

Tesla Inc

First Hydrogen Corp

Bayerische Motoren Werke AG

Airbus SE

Space Exploration Technologies Corp

Nikola Motor Company

Alphabet Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total active and pipeline capacity of low-carbon hydrogen projects in January 2024?

The total active and pipeline capacity of low-carbon hydrogen projects was 204 mtpa as of January 2024.

-

Which country had the highest hydrogen capacity in Q1 2024?

Canada leads in terms of capacity by a large margin, with over 90 mtpa across 77 different hydrogen hubs as of Q1 2024.

-

Which deal type accounted for the highest share of the hydrogen transition market in Q1 2024?

Partnership deal type led the hydrogen transition market in Q1 2024.

-

Which company led the hydrogen transition market?

Green Hydrogen International has the highest amount of proposed capacity with 87 mtpa related to two projects in Canada.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.