Car Rental Market Size, Share, Trends and Analysis by Customer Type, Location, Rental Sales by Channel and Segment Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Car Rental Market’ report can help you:

- Analyze the car rental industry with a brief overview.

- Enhance the target audience’s comprehension of the total addressable market (TAM), offering valuable insights into market potential.

- Identify the key regions witnessing the highest number of market dynamic activities such as mergers & acquisitions and venture financing.

- Provide insights into car rentals as per geographic region.

- Identify key market trends driving the growth of the market

- Anticipate changes in demand and adjust your business development strategies

How is our ‘Car Rental Market’ report different from other reports in the market?

- The report presents in-depth market sizing and forecasts at a segment level for more than 22 countries, including historical and forecast analysis for 2019-27 for market assessment.

- It gives detailed insights on segmentation by customer type (business and leisure), rental location (airport and non-airport), and rental sales by channel (online and offline).

- It provides information on market data on fleet size, rental occasion, and days, average revenue per day and rental length, and utilization rate.

- The report offers market trends and challenges impacting the car rental market, which is expected to help stakeholders align their service portfolio in line with the latest innovations and developments.

- The report offers deep value chain insights, explaining the various stages, enabling the stakeholders to identify the key stages in the process and the usage of emerging technologies that enhance productivity and cost-effectiveness.

- It provides detailed profiling of leading companies in the market for a deeper understanding of the competition.

- It gives an overview of M&A/venture financing deals, hiring trends, patent filing, and social media trends within the car rental market highlighting the potential of the market.

We recommend this valuable source of information to:

- Car Rental Companies and Tourism Operators

- Tech Mobility Startup Companies

- Automotive OEMs

- Consulting and Professional Services Firms

- Venture Capitalist/Investment Firms

Car Rental Market Report Overview

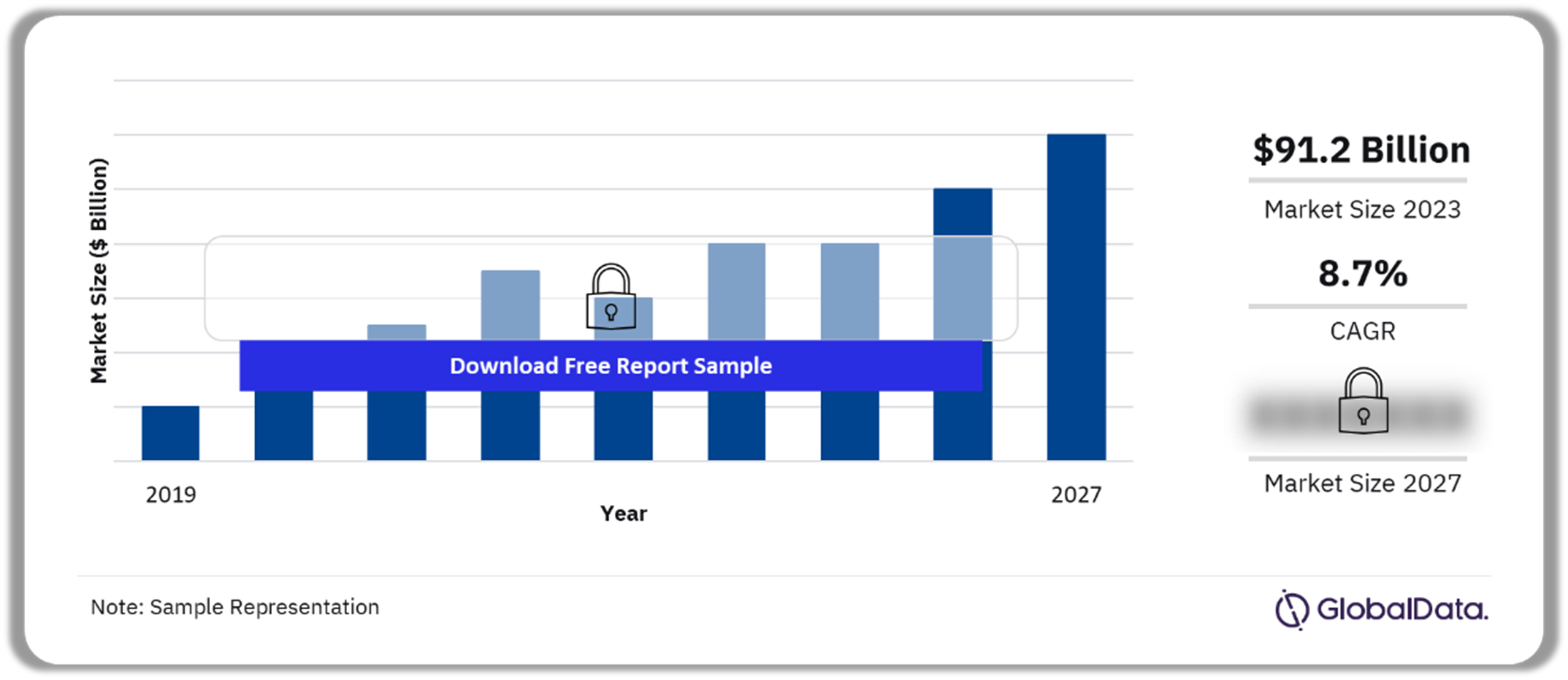

The car rental market was valued at $92.1 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% over the forecast period. The car rental (hiring of a passenger vehicle for self-drive, which includes cars and small vans, by both business and leisure travelers for the short-term duration; excluding leasing and long-term rentals) market has evolved intensely in recent years and is expected to grow further.

Car Rental Market Outlook, 2019-2027 ($ Billion)

Buy the Full Report for Additional Insights on the Car Rental Market Size Projections, Download a Free Report Sample

In the ever-evolving landscape of the car rental industry, a prominent trend gaining traction is the increasing popularity of flexible rental models. Companies such as Avis and Hertz offer versatile rental options tailored to diverse purposes, such as airport and railway transfers, outstation transport, one-way intercity transfers, and intercity transportation. This shift marks a departure from traditional fixed-term rentals, emphasizing the accommodation of varied consumer needs through innovative services.

Simultaneously, the demand for rental cars is on the rise, driven by technological advancements and shifts in consumer behavior. Today’s consumers seek highly efficient car rental services to meet their transportation needs. A shift in online customer behavior benefits large businesses, and the adoption of technology is expected to open greater opportunities for the car rental industry to expand its market scope.

Technologies such as artificial intelligence (AI), smart parking, and driverless cars empower rental companies to stay competitive and adapt to the future car rental market. The growing use of technology may lead to significant reductions in overhead expenses in the future, particularly with the imminent introduction of self-driving cars or autonomous vehicles (AVs) offering on-demand car rentals.

Furthermore, the prevalence of airport rentals indicates a robust demand for fly-drive offerings among both corporate and leisure travelers. Airlines such as British Airways, Virgin Atlantic, and Icelandair provide customers with the option to purchase flight+car packages, incorporating discounted car hire along with their flight bookings. These promotional efforts primarily target the leisure market segment, capitalizing on the complexity of the business travel market. Fly-and-drive packages leverage this trend by offering travelers a comprehensive solution, facilitating a seamless transition from flights to rental cars and enhancing overall travel efficiency and flexibility.

| Market size (2023) | $91.2 Billion |

| CAGR (2024 – 2027) | 8.7% |

| Forecast Period | 2024 – 2027 |

| Historical Period | 2019 – 2023 |

| Customer Type & Rental Location Segment | Business (Airport, Non-airport), Leisure (Airport, Non-airport), and Insurance Replacement |

| Rental Sales by Channel Segment | Offline and Online (Direct Suppliers and Intermediaries) |

| Key Companies | Enterprise Holdings Inc., Avis Budget Group Inc., Hertz Global Holdings Inc., Sixt SE, Europcar Mobility Group SA, Localiza Rent a Car SA, Tourism Holdings Rentals Ltd, SK Rent A Car Co Ltd, ALD SA, and Movida Participacoes SA |

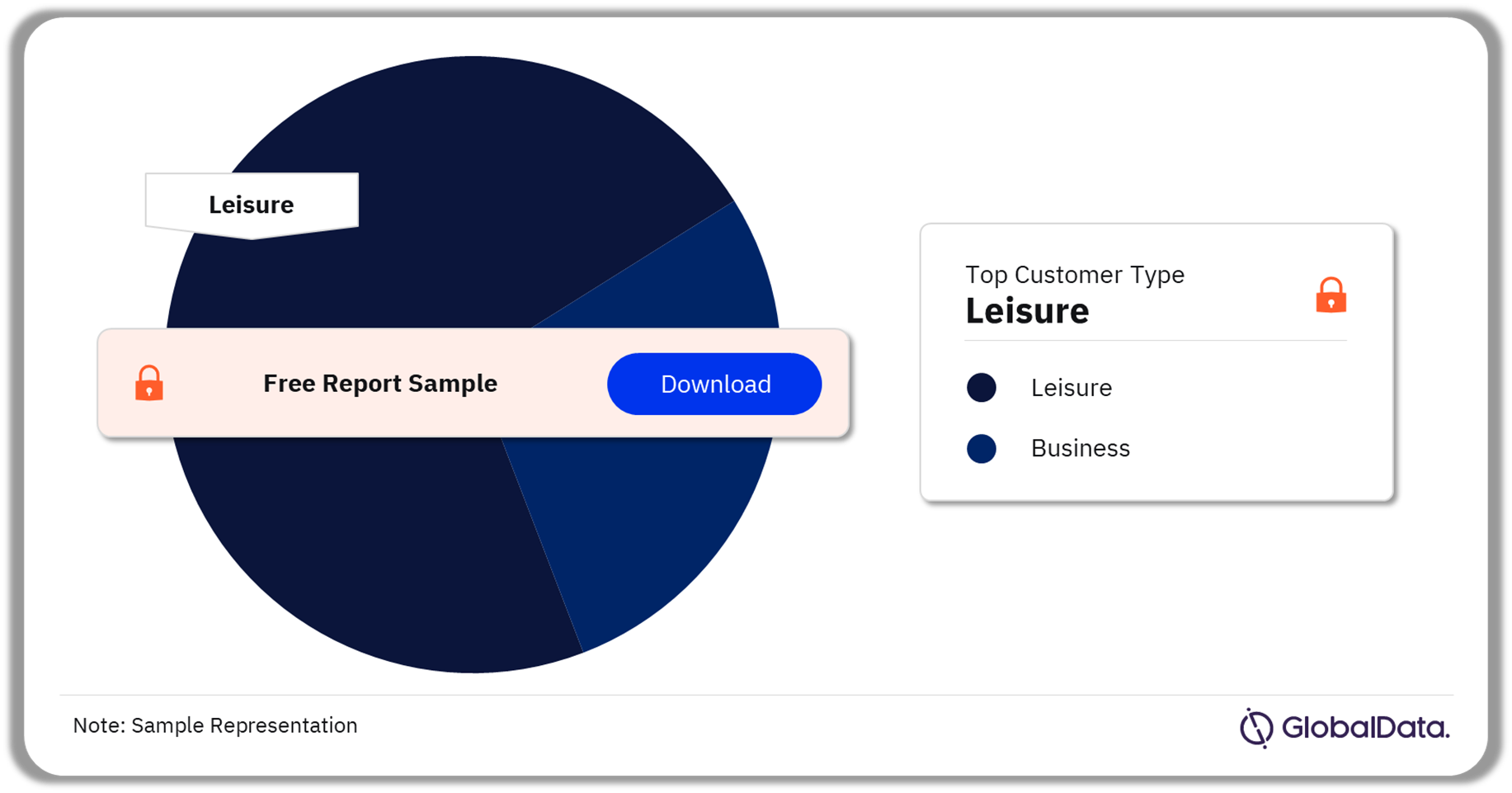

Car Rental Market Analysis by Customer Type

Based on the customer type, leisure trips are a major driver of car rental demand, as many travelers prefer to use their transportation when exploring new destinations. The desire for flexibility, convenience, cost-effectiveness, safety, and comfort are all factors that are likely to continue to drive demand for car rental services for leisure trips.

Car Rental Market Analysis by Customer Type, 2023 (%)

Buy the Full Report for More Information on Customer Types in the Car Rental Market, Download a Free Report Sample

Leisure travelers often prefer car rentals due to the flexibility and independence they provide. Unlike business or time-sensitive travel, leisure trips allow individuals to explore at their own pace, visit multiple destinations, and venture into off-the-beaten-path areas. Renting a car offers the freedom to create a customized itinerary, enabling spontaneous detours and a more personalized travel experience. Additionally, having a rental car is convenient for groups, and accommodates the transportation of luggage and equipment, contributing to an overall sense of adventure and exploration during leisure journeys.

In addition, business travelers frequently opt for car rentals due to the imperative need for flexibility, efficiency, and autonomy in their hectic schedules. Renting a car allows them to seamlessly navigate between meetings and locations, conduct business calls or review documents in a private space, and adhere to tight schedules. The convenience and time savings associated with having a dedicated mode of transportation contribute to increased productivity. Additionally, in locations with limited public transportation options, car rentals become essential for reliable and punctual travel. Loyalty programs and corporate discounts further make car rentals a practical and cost-effective choice for business professionals on the move.

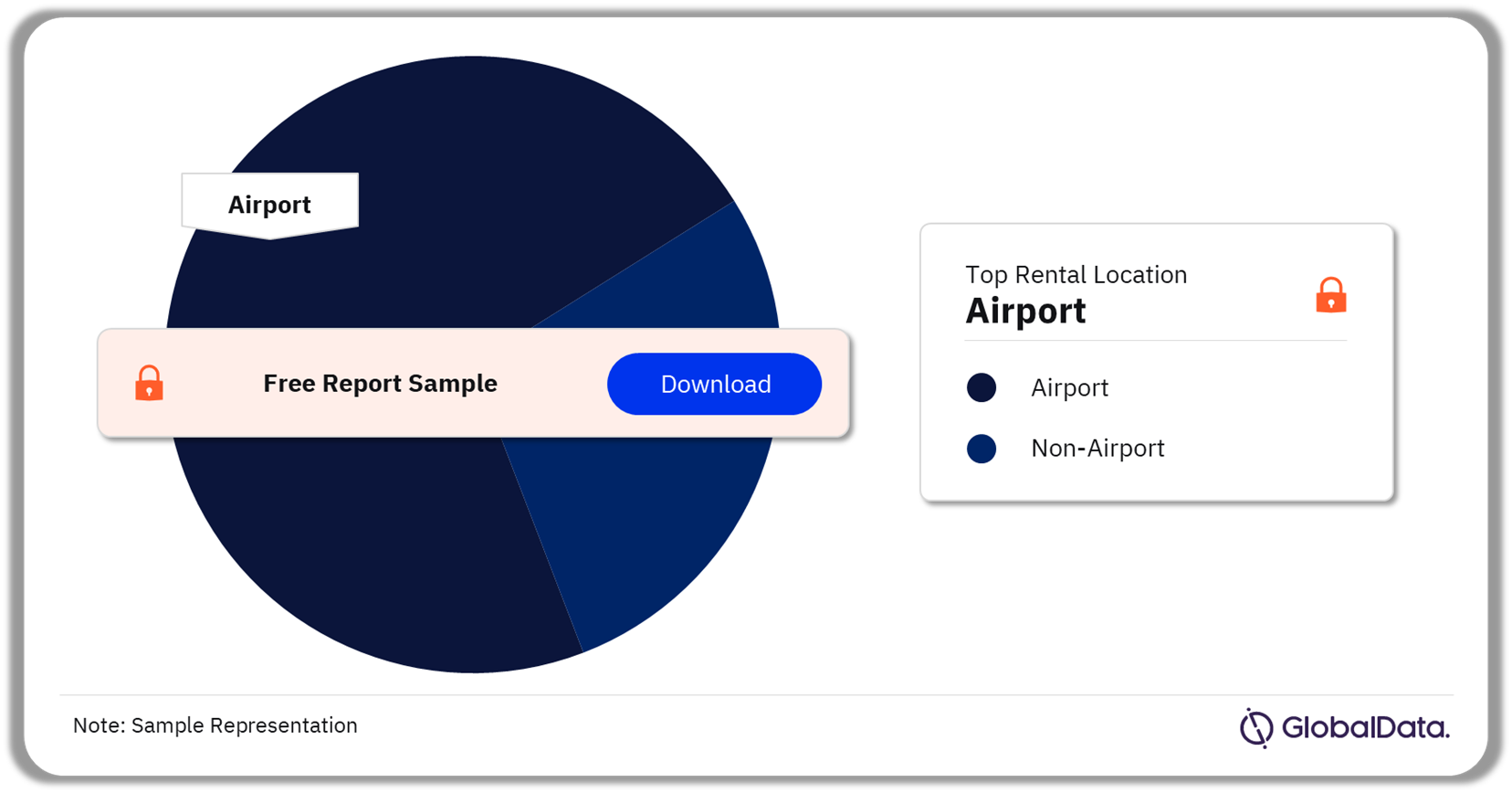

Car Rental Market Analysis by Rental Location

GlobalData predicts the continued significance of airports in the car rental sector, citing sustained demand for airport transportation in diverse travel scenarios, including both business and leisure trips. Notably, airports stand out as the preferred choice for renting vehicles, constituting a market share of over 40% in 2023. This segment is anticipated to uphold its dominant position in the market through the year 2027.

Airports serve as key hubs where individuals often initiate or conclude their journeys, making them prime locations for convenient and efficient access to rental vehicles. This strategic positioning contributes substantially to the expansion and sustainability of the car rental industry, with airport locations maintaining a significant market share and contributing significantly to the overall growth dynamics of the sector.

Car Rental Market Analysis by Rental Location, 2023 (%)

Buy the Full Report for More Information on Rental Location Revenues in the Car Rental Market, Download a Free Report Sample

Non-airport locations also significantly contribute to the market growth of car rentals. This is evident as an increasing number of travelers seek rental services at locations beyond airports, both for business and leisure purposes. Factors such as convenience, accessibility, and the desire for flexibility in local transportation contribute to the expansion of car rental services in non-airport settings. As a result, this segment plays a crucial role in the overall growth and diversification of the car rental industry, capturing a substantial market share and contributing to the evolving landscape of mobility services.

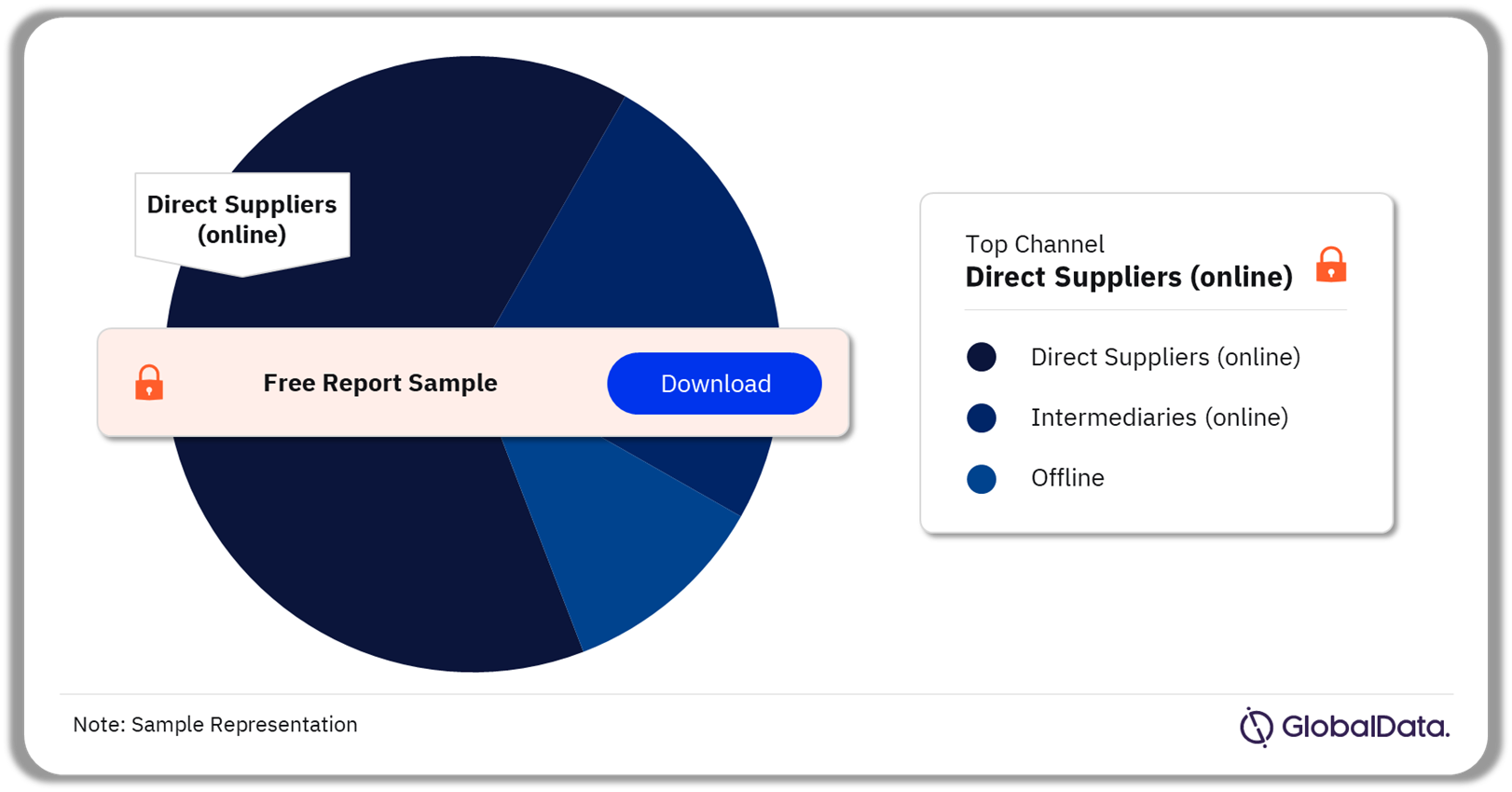

Car Rental Market Analysis by Rental Sales By Channel

Many car rental companies today use a combination of offline and online channels to offer their customers a seamless and convenient rental experience. Post-pandemic, car rental companies are witnessing a surge in the use of online channels such as websites and mobile apps, where customers can browse and book rental cars from the comfort of their own homes.

Car rental companies are also utilizing online travel agencies (OTAs) and third-party booking platforms to reach a wider audience. These online car rental options encompass both direct suppliers and intermediaries, providing a blend of convenience, flexibility, and often more affordable rates compared to traditional physical rental agencies.

Car Rental Market Analysis by Channel, 2023 (%)

Buy the Full Report for More Channel Insights into the Car Rental Market, Download a Free Report Sample

The ascent of online car rental bookings can be attributed significantly to the impact of the COVID-19 pandemic. Many travelers have chosen contactless and online booking methods as a precautionary measure to minimize the risk of virus exposure. Overall, the inclination towards booking car rentals online is anticipated to persist, reflecting the growing preference among consumers for convenient and efficient ways to arrange their travel accommodations.

Car Rental Market Analysis by Region

In 2023, North America emerged as the global leader in the car rental market, with the US spearheading market demand. Major industry players including Hertz, Avis, and Enterprise Rent-A-Car dominated this market segment. The anticipated recovery of the market over the forecast period is expected to be propelled by technological advancements, including automatic damage detection and contactless services. Additionally, a shift toward electric vehicles is foreseen to contribute to the market’s resurgence.

Car Rental Market Analysis by Region, 2023 (%)

Buy the Full Report for Additional Regional Insights into the Car Rental Market, Download a Free Report Sample

Europe continues to hold its position as the second-largest market for car rentals, propelled by the expanding domestic and international tourism sectors. This trend is anticipated to positively impact market growth throughout the forecast period. The European car rental market has witnessed a notable surge in demand, particularly following the easing of COVID-19 pandemic-related restrictions, leading to a resumption of travel. The heightened demand is predominantly attributed to the leisure segment, with individuals opting to rent cars for road trips and vacations as a preferred mode of transportation.

On the other hand, the Asia-Pacific region stands as a significant and burgeoning market for car rentals. With a growing economy and increasing urbanization, the demand for rental vehicles has been on the rise. Factors such as business travel, tourism, and changing consumer preferences contribute to the importance of the car rental market in the Asia-Pacific region. As mobility needs evolve and awareness of rental services expands, the car rental industry in Asia-Pacific is expected to play a pivotal role in meeting the diverse transportation requirements of the region.

Leading Companies in the Car Rental Market

- Enterprise Holdings Inc.

- Avis Budget Group Inc.

- Hertz Global Holdings Inc.

- Sixt SE

- Europcar Mobility Group SA

- Localiza Rent A Car SA

- Tourism Holdings Rentals Ltd.

- SK Rent A Car Co Ltd.

- ALD SA

- Movida Participacoes SA

Other Car Rental Market Companies Mentioned

Getaround Inc., Gire AS, Liftango Pty Ltd., Turo Inc., Autohellas SA, and Blue Bird Group, among others.

Scope

GlobalData Plc has segmented the car rental market report by customer type & rental location, rental sales by channel, and by region:

Car Rental Customer Type & Rental Location Outlook (Revenue, $Billion, 2019-2027)

- Business

- Airport

- Non-Airport

- Insurance Replacement

- Leisure

- Airport

- Non-Airport

Car Rental Sales by Channel Outlook (Revenue, $Billion, 2019-2027)

- Offline

- Online

- Direct Suppliers

- Intermediaries

Car Rental Regional Outlook (Revenue, $ Million, 2019-2027)

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- The UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- Indonesia

- Australia

- South Korea

- Rest of Asia Pacific

- South & Central America

- Brazil

- Argentina

- Chile

- Peru

- Colombia

- Rest of South & Central America

- Middle East & Africa

- The United Arab Emirates (UAE)

- Saudi Arabia

- South Africa

- Morocco

- Egypt

- Rest of the Middle East & Africa

Key Highlights

The global car rental market was valued at $91.2 billion in 2023. The market is expected to grow at a CAGR of 8.7% during 2024-2027. The tourism industry has been a major contributor to the growth of the car rental market. The car rental market has been experiencing an increasing demand for rental cars due to the rise in international and domestic travel. With the increase in travel, people are looking for more flexible transportation options, and economy rental cars provide a convenient solution.

Reasons to Buy

• This market intelligence report offers a thorough, forward-looking analysis of the global car rental market by customer type (business, leisure) & rental location (airport, non-airport), rental sales by channel (online, offline), region, and key drivers in a concise format to help executives build proactive and profitable growth strategies.

• Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in the car rental market.

• The report also covers key insights on fleet size, rental occasion and days, average revenue per day and rental length, and utilization rates related to the car rental market.

• With more than 100 charts and tables, the report is designed for an executive-level audience, enhancing presentation quality.

• The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in car rental market.

• The broad perspective of the report coupled with comprehensive, actionable detail will help automotive stakeholders, car rental providers, and other intermediaries succeed in growing the car rental market globally.

Key Players

Enterprise Holdings IncAvis Budget Group Inc

Hertz Global Holdings Inc

Sixt SE

Europcar Mobility Group SA

Localiza Rent A Car SA

Tourism Holdings Rentals Ltd

SK Rent A Car Co Ltd

ALD SA

Movida Participacoes SA

Table of Contents

Table

Figures

Frequently asked questions

-

What is the global car rental market size in 2023?

The global car rental market size was valued at $91.2 billion in 2023.

-

What will be the global car rental market size in 2027?

The global car rental market size is expected to reach $129.0 billion by 2027.

-

What is the car rental market growth rate?

The global car rental market is expected to grow at a CAGR of 8.7% during the forecast period (2024-2027).

-

What are the key car rental market trends?

Airport rentals encouraging fly & drive packages, the popularity of flexible rental models, and the function and integration of technology, among others, are expected to favor the car rental market growth globally.

-

What are the key car rental market segments?

The key car rental market segments are as below:

Customer Type & Rental Location Segment: Business (Airport, Non-airport), Leisure (Airport, Non-airport), and Insurance Replacement

Rental Sales by Channel Segment: Offline and Online (Direct Suppliers and Intermediaries)

-

Which are the leading car rental companies globally?

The leading car rental companies are Enterprise Holdings Inc.; Avis Budget Group Inc.; Hertz Global Holdings Inc.; Sixt SE, Europcar Mobility Group SA; Localiza Rent A Car SA; Tourism Holdings Rentals Ltd; SK Rent A Car Co Ltd; ALD SA; and Movida Participacoes SA.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Car Rental reports