Counter-Drones Market Size, Trends and Analysis by Technology, Application, End-user, Platform, Region and Segment Forecast to 2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Counter Drones Market Overview

The counter drones market size by revenue will be valued at $1.53 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 19.3% over the forecast period. The adoption of counter-drones will be supported by the increasing use of drones for criminal activities and increasing adoption of drones in major countries.

Counter-drone technology, also known as counter-UAS, C-UAS, anti-drone, or counter-UAV technology, refers to systems that are used to detect and/or disable unmanned aircraft. As concerns mount around the potential security threats that drones may pose to civilian and military entities, a new market for counter-drone technology is rapidly emerging.

The market faces significant challenges from interdiction hazards and privacy concerns which are expected to impact growth over the forecast period. Some interdiction techniques might be dangerous if deployed in populated areas. Drones intercepted by kinetic means can crash with considerable force. Further, net-based systems equipped with a parachute involves a risk if the parachute fails to deploy correctly or if the interdiction occurs at a low altitude. Counter-drone systems are a form of surveillance technology and pose a risk to privacy if misused or if the data they collect is mismanaged.

Counter drones Market Outlook, 2021-26 ($ Billion)

View Sample Report for Additional Insights on the Counter drones Market Forecast, Download a Free Report Sample

Criminality (activities such as goods smuggling, hacking, and theft involving commercial/recreational drones is a major factor driving the development of C-UAS systems. Globally, there has been a 25% increase in drone related criminal activities between 2021 and 2022, paving the way for investments in counter-drones technologies by relevant authorities. Due to the relatively lower technological threshold for civil C-UAS systems, this sub-segment of the market is seeing much greater activity from SMEs and start-ups, while the military sub-segment continues to be dominated by prime companies such as Leonardo, Lockheed Martin, Raytheon Technologies, and others.

The civilian market represents a significant opportunity for producers given the ready availability of commercial UAVs and security breaches in major countries. As such, potential customers for C-UAS systems include, but are not limited to, the defense sector, national governments, private security, stadiums/amusement parks/public arenas, airports and transportation hubs, petroleum/chemical/electric grids, and nuclear and chemical installations, among other state and private security bodies.

Unmanned Aerial Vehicles/Systems (UAVs/UASs) have witnessed tremendous advances in terms of the number of deployed systems, as well as individual system capabilities, which in turn have led to the massive proliferation of UASs, leading to a steep demand curve that is only anticipated to rise over the next decade. Corresponding with this proliferation, as well as the employment of UAS in an increasing number of roles (Loyal Wingman, Unmanned Refueling, etc.) countries will be required to increase their investment in systems capable of countering drone threats.

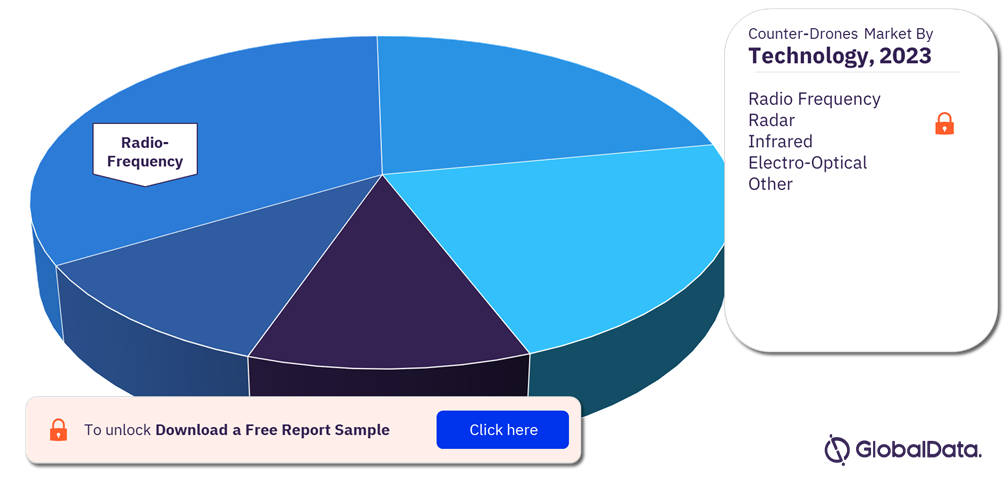

Counter-drones Market Segmentation by Technology

Counter-drones market by technology, includes radar, radio frequency, electro-optical, infrared, and others. Radar is one of the most used capabilities in C-UAS developers’ arsenals when developing new systems. Leaders in radar within C-UAS include Rafael, which produces I-Dome. Radio-frequency sensors detect, locate, and in some cases identify nearby drones by scanning for the frequencies on which most drones are known to operate. This sensor technology is commonly deployed in solutions targeted at resisting small drones, particularly in law enforcement roles.

Counter-drones Market Share by Technology, 2023 (%)

Fetch Sample PDF for Technology Stream-Specific Revenues and Shares, Download a Free Report Sample

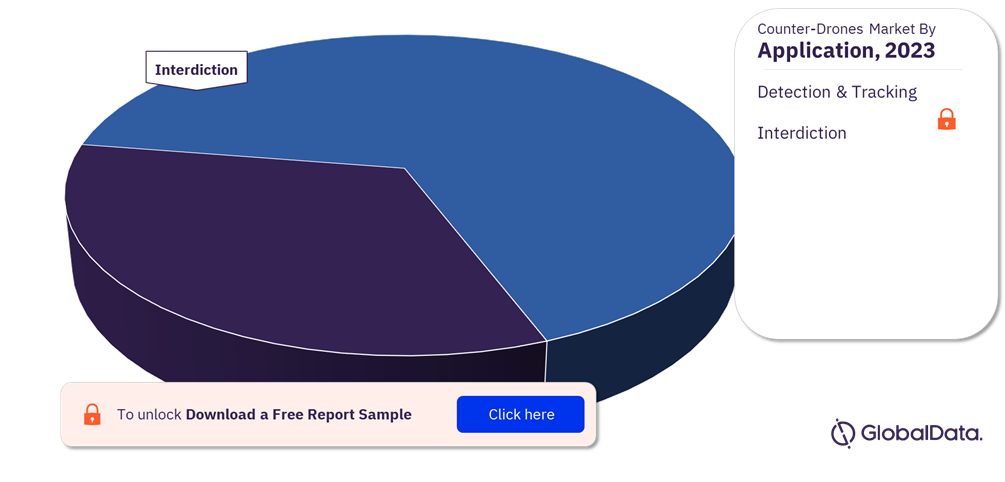

Counter-drones Market Segmentation by Application

Counter-drones market by application includes detection & tracking, and interdiction. Detection & tracking broadly describes the capability to locate and track incoming UAS threats. The capability is a key prerequisite for a successful C-UAS capability, with being able to identify and locate an incoming threat as the first step in the counter-drone kill chain. Manufacturers are investing heavily in interdiction technologies such as laser and high-power microwaves.

By application, the interdiction segment accounted for the largest market share in 2022 and is expected to continue to dominate over the forecast period growing at a CAGR of more than 16% during the forecast period.

Counter-drones Market Share by Application, 2023 (%)

Fetch Sample PDF for Application-Specific Revenues and Shares, Download a Free Report Sample

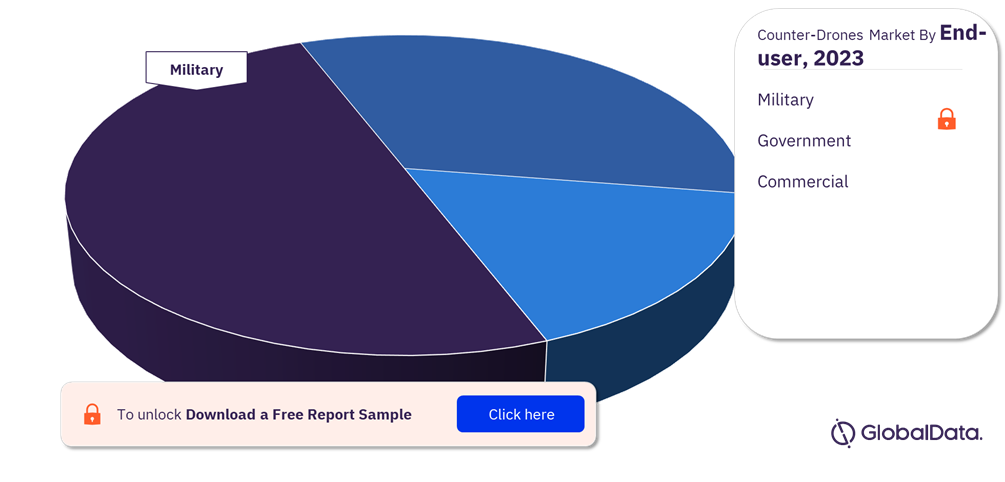

Counter-drones Market Segmentation by End-user

Counter-drones market by end-user includes military, government, and commercial. In FY2023, the Department of Defense (DOD) plans to spend at least $668 million on C-UAS research and development and at least $78 million on C-UAS procurement. In December 2019, the department’s various C-sUAS development programs were streamlined, with the Army acting as the executive agent overseeing all C-sUAS development efforts. On January 6, 2020, the Secretary of Defense approved the implementation plan of the new office, known as the Joint C-sUAS Office (JCO).

Criminality involving drones ranges from careless to intentional, from troublesome to malicious. Some forms of criminality are directed at an illicit profit, such as goods smuggling, hacking, and theft. These forms of actions generate demand for C-UAS systems in sensitive locations such as border areas and prisons. Other, graver forms of criminality include politically motivated attacks against VIPs and terrorist attacks against essential infrastructure.

By end-user, the military segment accounted for the largest market share in 2022 and is expected to continue to dominate over the forecast period growing at a CAGR of more than 17% during the forecast period.

Counter-drones Market Share by End-user, 2023 (%)

Fetch Sample PDF for End-User-Specific Revenues and Shares, Download a Free Report Sample

Counter-drones Market Segmentation by Platform

Counter-drones market by platform includes ground-based, handheld, and UAV-based. Ground-based systems refer to systems designed to be used from either stationary position on the ground or mounted on vehicles and/or operated on the move. Different technologies for detection and interdiction can be used along with these ground-based systems. Handheld systems refer to systems designed to be operated by an individual by hand, most of these systems resemble a rifle. UAV-based systems are designed to be mounted on drones.

By platform, the ground-based segment accounted for the largest market share in 2022 and is expected to continue to dominate over the forecast period growing at a CAGR of more than 17% during the forecast period.

Counter-drones Market Share by Platform, 2023 (%)

Fetch Sample PDF for Platform-Specific Revenues and Shares, Download a Free Report Sample

Counter-drones Market Analysis by Region

The North American drones market value was the highest in 2022, capturing over 30% of the overall market size. The regional demand was led by the US and China collectively accounting for over 40% of the counter-drones market in 2022. The rising use of commercial drones for criminal activities will drive the regional demand for counter-drone systems.

North America is projected to retain the largest share by 2026 accounting for over 30% of the global counter-drones market value, with a forecasted growth rate exceeding 17% from 2023 to 2026. The growing geopolitical unrest along the borders of Asian countries will favor the proliferation of the counter-drones market in Asia Pacific. Apart from the Asia Pacific market, the Middle East and Africa counter-drone market is also expected to witness growth over the near future, registering a CAGR of more than 13% from 2023 to 2026.

North America Counter-drones Market Share by Country, 2023 (%)

Fetch Sample PDF for Region-Specific Revenues and Shares, Download a Free Report Sample

Counter-drones Market - Competitive Landscape

Investments in R&D of new counter-drone technology are increasing, making the sector lucrative for both existing and new players in the market. Many local players are entering the market supplying various counter-drone solutions. Despite the presence of some larger dominant players such as CACI International Inc. and Raytheon Technologies Corp, smaller companies like Droneshield Ltd. and SKYLOCK have been able to successfully win military contracts.

The leading companies that specialize in counter-drones are Blighter Surveillance Systems Ltd., Dedrone Inc, D-Fend Solutions AD Ltd, Israel Aerospace Industries Ltd., Raytheon Technologies Corp., Leonardo SpA, Lockheed Martin Corp., Rafael Advanced Defense Systems Ltd, CACI International Inc, and Northrop Grumman Corp.

Counter-Drones Market Vendor Growth Innovation Matrix

Leading Players in the Counter-drones Market

- Blighter Surveillance Systems Ltd.

- CACI International Inc.

- Northrop Grumman

- Leonardo SpA

- Lockheed Martin Corporation

- Israel Aerospace Industries

- Raytheon Technologies Corporation

- Rafael Advanced Defense Systems Ltd

- D-Fend Solutions AD Ltd

- Dedrone Inc

Other Counter-drones Market Vendors Mentioned

DroneShield Ltd, Liteye systems, Accipiter Radar, SKYLOCK, Boeing, Airbus Group SE, QinetiQ Group PLC, Thales Group, Advanced Radar Technologies S.A., and Aaronia AG

To Know More About Leading Counter-drones Market Players, Download a Free Report Sample

Counter-drones Market Research Scope

| Market size in 2023 | $1.53 billion |

| Market size in 2026 | $2.52 billion |

| CAGR | 19.3% from 2023 to 2026 |

| Forecast period | 2023-2026 |

| Historic data | 2021-2022 |

| Report scope & coverage | Revenue forecast, competitive index, company landscape, growth trends |

| Technology | Radar, radio frequency, electro-optical, infrared, and others |

| Application | Detection & tracking and interdiction |

| End-user | Military, government, and commercial |

| Platform | Ground-based, handheld, and UAV-based |

| Region Coverage | North America, Europe, Asia Pacific, South & Central America, Middle East & Africa |

| Country Coverage | US, Canada, UK, France, Germany, Russia, Italy, Netherlands, China, India, Japan, South Korea, Australia, UAE, Saudi Arabia, Israel, Qatar, Mexico, Brazil, Colombia |

| Key Companies | Blighter Surveillance Systems Ltd., Dedrone Inc, D-Fend Solutions AD Ltd, Israel Aerospace Industries Ltd., Raytheon Technologies Corp., Leonardo SpA, Lockheed Martin Corp., Rafael Advanced Defense Systems Ltd, CACI International Inc, and Northrop Grumman Corp. |

Counter-drones Market Segments and Scope

GlobalData Plc has segmented the global counter-drones market report by technology, application, end-user, platform, and region:

Counter-drones Market Technology Outlook (Revenue, $Million, 2021-2026)

- Radar

- Radio frequency

- Electro-optical

- Infrared

- Others

Counter-drones Market Application Outlook (Revenue, $Million, 2021-2026)

- Detection & tracking

- Interdiction

Counter-drones Market End-user Outlook (Revenue, $Million, 2021-2026)

- Military

- Government

- Commercial

Counter-drones Market Platform Outlook (Revenue, $Million, 2021-2026)

- Ground-based

- Handheld

- UAV-based

Counter-drones Market Regional Outlook (Revenue, $Million, 2021-2026)

- North America

- The US

- Canada

- Asia-pacific

- China

- Japan

- South Korea

- Australia

- India

- Rest of Asia Pacific

- Europe

- Germany

- The UK

- France

- Italy

- Russia

- The Netherlands

- Rest of Europe

- South and Central America

- Mexico

- Brazil

- Colombia

- Rest of South and Central America

- Middle East and Africa

- Israel

- The UAE

- Saudi Arabia

- Qatar

- Rest of Middle East and Africa

The market intelligence report provides an in-depth analysis of the following –

- Counter-drones market outlook: analysis as well as historical figures and forecasts of revenue opportunities from the technology, application, end-user, platform, and region segments.

- The competitive landscape: an examination of the positioning of leading players in the counter-drones market.

- Company snapshots: analysis of the market position of leading competitors in the counter-drones market.

- Underlying assumptions behind our published base-case forecasts, as well as potential market developments that would alter, either positively or negatively, our base-case outlook.

Key Highlights

The global Counter drones market size reached USD 1.24 billion in 2022, according to a new report by GlobalData Plc. The adoption of counter drones will be supported by increasing use of commercial drones for criminal activities and increasing government spending on R&D and procurement of counter drone systems.

Reasons to Buy

- This market intelligence report offers a thorough, forward-looking analysis of the global counter drones market by technology, application, end-user, platform, region, and key opportunities in a concise format to help executives build proactive and profitable growth strategies.

- Accompanying GlobalData’s forecast products, the report examines the assumptions and drivers behind ongoing and upcoming trends in counter-drone markets.

- With more than 140 charts and tables, the report is designed for an executive-level audience, with enhanced presentation quality.

- The report provides an easily digestible market assessment for decision-makers built around in-depth information gathered from local market players, which enables executives to quickly get up to speed with the current and emerging trends in counter-drone markets.

- The broad perspective of the report coupled with comprehensive, actionable detail, will help aerospace, defense & security stakeholders, service providers, and other counter-drone players succeed in growing the counter-drones market globally.

Key Players

Blighter Surveillance Systems LtdCACI International Inc

Northrop Grumman Corp

Leonardo SpA

Lockheed Martin Corp

Israel Aerospace Industries Ltd

RTX Corp

Rafael Advanced Defense Systems Ltd

D-Fend Solutions AD Ltd

Dedrone Inc

Table of Contents

Table

Figures

Frequently asked questions

-

What will be the counter-drones size in 2023?

The counter-drones market size globally will be valued at $1.53 billion in 2023.

-

What is the counter-drones market growth rate?

The counter-drones market is expected to grow at a CAGR of 19.3% during the forecast period (2023-2026).

-

What are the key counter-drones market drivers?

Increasing use of commercial drones for criminal activities and increasing adoption of drones in major countries are stimulating the growth of the counter-drones market worldwide.

-

What are the key counter-drones market segments?

Technology: Radar, Radio Frequency, Electro-optical, Infrared, and Others

Application: Detection & Tracking, and Interdiction

End-user: Military, Government, and Commercial

Platform: Ground-based, Handheld, and UAV-based

Regions: North America, Europe, Asia Pacific, South and Central America, Middle East and Africa.

-

Which are the leading counter-drone companies?

The leading counter-drone companies globally are Blighter Surveillance Systems Ltd., Dedrone Inc, D-Fend Solutions AD Ltd, Israel Aerospace Industries Ltd., Raytheon Technologies Corp., Leonardo SpA, Lockheed Martin Corp., Rafael Advanced Defense Systems Ltd, CACI International Inc, and Northrop Grumman Corp.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Unmanned Aerial Vehicles reports